For the first time since 2007, AIG Companies has taken over as the top seller of annuities according to recently released data from the LIMRA Secure Retirement Institute (LIMRA SRI).

New York City-based AIG, which is celebrating its 100th anniversary in 2019, took the top spot for 2018 from 2017 champ Jackson National Life with a total of $18.4 billion in total annuity sales (up from $14.3 billion in 2017), of which $11.6 billion were in fixed annuities (from $7.9 billion in 2017) and $6.8 billion in variable annuities (up from $6.4 billion in 2017).

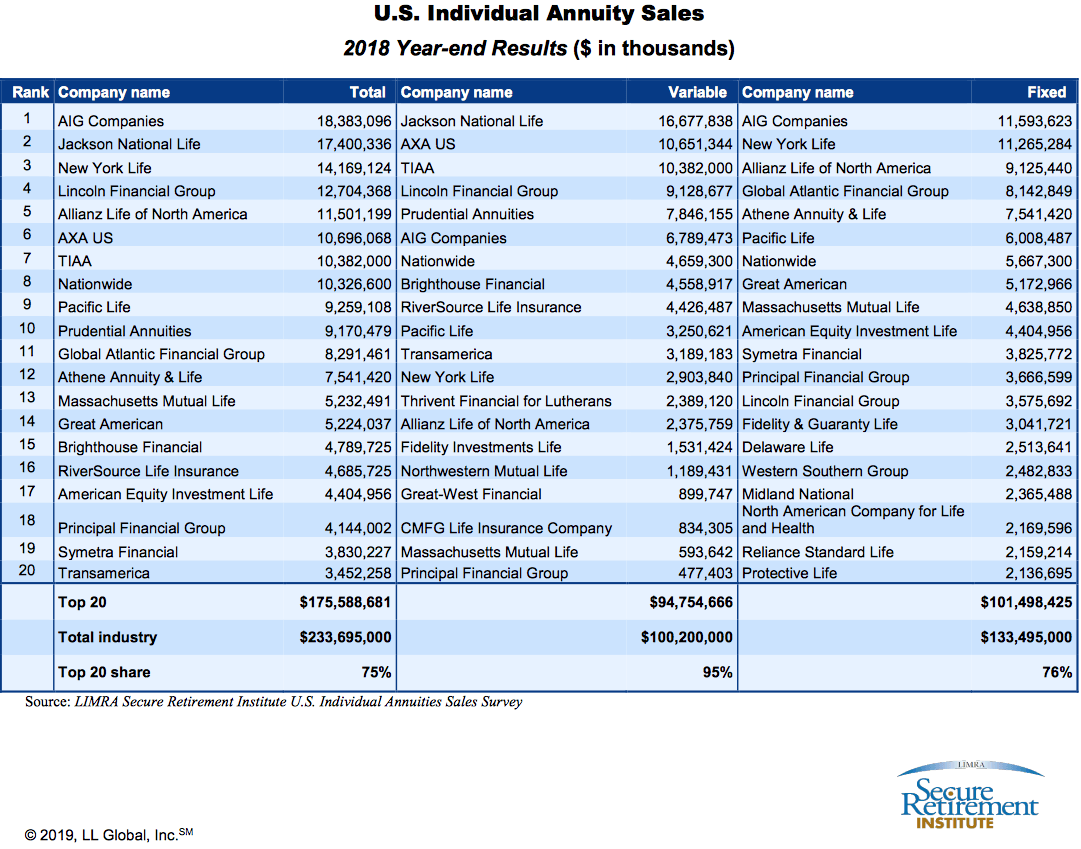

Aside from a new sales leader, there are two new companies in this year’s top five compared to 2017 sales, as Lincoln Financial Group jumped from the eighth spot to the fourth spot and Allianz Life jumped from seventh to fifth. TIAA and AXA US dropped out of the top five for 2018. The top five sellers of total annuities in 2018 representing 32% of market share were:

- AIG Companies

- Jackson National Life

- New York Life

- Lincoln Financial Group

- Allianz Life of North America

The top 10 companies held 53% market share in 2018 (see full rankings below).

Fixed annuities not only had a record-breaking sales year (sales rose 27% to $133.5 billion, an all-time high), but they also have a new sales leader. According to LIMRA SRI research, this is the fourth consecutive year that annual fixed annuity sales surpassed $100 billion.

The top three sellers of fixed annuities were:

- AIG Companies

- New York Life

- Allianz Life of North America

Those three companies alone represented 24% market share for total fixed annuity sales. In 2018, the top 10 companies held 55% of the market.

This was the first time in six years total variable annuity (VA) sales have grown. The three top sellers of variable annuities were:

- Jackson National Life

- AXA US

- TIAA

Those three represented 38% market share, and the top 10 companies held 78% percent share of the variable annuity sales market in 2018.

As LIMRA previously announced, total annuity sales in 2018 increased 15% to $233.7 billion, compared with 2017 results.

“Individual annuity sales for 2018 finished the year strong, particularly sales of fixed annuity products,” said Todd Giesing, director, Annuity Research, LIMRA Secure Retirement Institute. “All fixed annuity products experienced growth in 2018, and fixed annuity sales accounted for nearly 60% of overall individual annuity sales, a significant change from just five years ago.”

Fixed indexed annuity sales rose 27% to $69.6 billion, compared with prior year. This is also a record and exceeds the previous annual fixed indexed annuity sales record by $10 billion.

Total variable annuity sales for 2018 were $100.2 billion, a 2% increase over 2017 results.