About 18% of all U.S. households own a deferred annuity, estimates the LIMRA Secure Retirement Institute, yet data suggest many annuities will never be activated for monthly income, leaving potential tax consequences for beneficiaries.

Many of these individuals can benefit by learning more about exchanges under Internal Revenue Code section 1035 of the Federal Tax Law, which can offer tax benefits for beneficiaries as well as provide tax-free long-term care (LTC) benefits, should they be needed.

“Americans have nearly $3 trillion in assets in fixed and variable annuities,” said Chris Coudret, vice president and chief distribution officer at Indianapolis-based carrier OneAmerica1. “Annuities can be a more versatile way to provide income during retirement than many people – and financial professionals – realize.”

A recently introduced consumer resource, Guide to Long-Term Care Planning Using 1035 Exchanges, explores the basics of how 1035 exchanges can benefit individuals and includes several real-life scenarios.

“The Pension Protection Act (PPA) provides meaningful tax- and long-term care planning advantages to consumers,” said Jesse Slome, director of the American Association for Long-Term Care Insurance (AALTCI), publisher of the guide. “Few people are familiar with this provision, which encourages individuals to plan for the possibility of needing additional income to cover LTC needs.”

“The Pension Protection Act (PPA) provides meaningful tax- and long-term care planning advantages to consumers,” said Jesse Slome, director of the American Association for Long-Term Care Insurance (AALTCI), publisher of the guide. “Few people are familiar with this provision, which encourages individuals to plan for the possibility of needing additional income to cover LTC needs.”

Among other provisions, the PPA enables income tax-free withdrawals from specific annuity contracts that pay for qualifying LTC expenses or LTC insurance premiums. This includes fixed interest annuities with LTC benefits.

These annuities provide tax deferral and non-LTC liquidity, while offering a guaranteed payout benefit and the option for lifetime LTC benefits. If policyholders don’t utilize their full LTC benefits, a death benefit passes to the named beneficiary. They can be purchased for a single person or shared between two people, and premiums won’t increase.

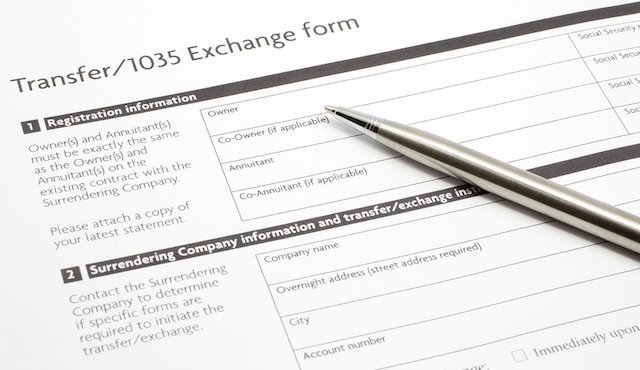

Repositioning assets to take advantage of the PPA is relatively simple, Coudret said. Under section 1035, an existing annuity can be exchanged into a new annuity on a tax-free basis, so all one needs to do is transfer all or a portion of the existing annuity into a hybrid annuity product featuring LTC protection.

“This new guide can be a tremendous help to financial professionals looking for information and resources for their client conversations,” said Coudret.

For more information about OneAmerica LTC solutions, visit www.oneamerica.com.

1 Table 25, Year-End Deferred Annuity Assets by Market Type, U.S. Individual Annuity Yearbook – 2016, LIMRA Secure Retirement Institute, 2017.

Definitely a nice opportunity here.

Hybrid Long Term Care Annuities Offer New Ways To Fund LTC – LTC Partner

What a deal!

You can avoid the tax on the gains.

But you'll have a deductible equal to the entire deposit.

The only reason to buy a product like this is if you can't qualify for anything else!

Some people can’t qualify for something else.

And some people will never buy traditional LTC.