- 284

I'm interested in the opinions of the securities licensed (or formerly licensed) WL experts on this subject That is, this is a shameless callout to brandon, larry , DHK etc,,,to further my education...thanks in advance.

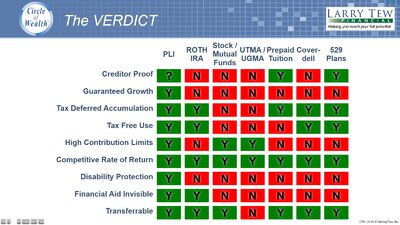

. My initial take is that while the 529 would "on average" perform better as an accumulation tool I would be inclined to prefer a well designed blended par WL with PUA rider simply because the tool doesn't die at use the way the 529 would. That is the "miracle" of compounding continues to be used as life protection and retirement savings. moreover, the college money is needed at a specific date and with a 529 would be subject to the dangers of a sour market just when needed.

Thoughts?

. My initial take is that while the 529 would "on average" perform better as an accumulation tool I would be inclined to prefer a well designed blended par WL with PUA rider simply because the tool doesn't die at use the way the 529 would. That is the "miracle" of compounding continues to be used as life protection and retirement savings. moreover, the college money is needed at a specific date and with a 529 would be subject to the dangers of a sour market just when needed.

Thoughts?