I got into the business in 2020 mainly selling term, and GUL and some but par WL My upline who I was under would tell us the Guaranteed rate was 4% until they changed it in 2020. They would always run the illustrations. I would always tell people the same thing 4% until they changed it..

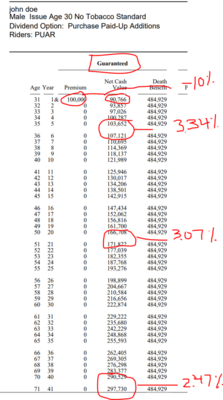

Friday I was on a webinar and we were going over Lafayette Life and they said my new upline said Lafayette Life doesn't have a guarantee rate it depends on the illustration and the non-forfeiture rate is between 2%-3.5%. They told me no one has a gaurenteed rate. The way he explained it, made no sense to me. I called other carriers and they said they do have a guaranteed rate.

What is a non-forfeiture rate couldn't find it I understand non-forfeiture options but never heard rate. What are you supposed to tell the client what rate the guaranteed cv is based on?

Friday I was on a webinar and we were going over Lafayette Life and they said my new upline said Lafayette Life doesn't have a guarantee rate it depends on the illustration and the non-forfeiture rate is between 2%-3.5%. They told me no one has a gaurenteed rate. The way he explained it, made no sense to me. I called other carriers and they said they do have a guaranteed rate.

What is a non-forfeiture rate couldn't find it I understand non-forfeiture options but never heard rate. What are you supposed to tell the client what rate the guaranteed cv is based on?