- Thread starter

- #11

Dins

Expert

- 49

A couple of questions:

How did you come up with the face amounts? Especially on the kids. How do these plans look if the kids do not increase the planned premium in the later years?

Did you allocate any additional premium to Dad's policy to accomplish his goals?

I was originally planning to go with a lower face amount, because I didn't see the need for the kids to have so much, but the Dad didn't respond as well to that. He really wanted to keep at least the 150K. Also, once I started building them, I needed a DB that would accommodate the premiums. When I ran lower DB, the premiums were automatically lowered in the later years to prevent a MEC.

I did not allocate any additional premium to Dad's policy. In fact, I was wondering if I should advise him to pay the min into that policy to keep it alive, whilst putting the difference into one of these for better accumulation. Thoughts?

I agree with scagnt83. Your 2nd question is an excellent point. One I probably didn't look into enough. He did ask the question, and I answered that they could pay less if needed, and that they didn't have to start at age 30 if they couldn't. I sold the premium flexibility as a benefit of this plan, but I didn't go into detail on what that looked like. Probably because I didn't want him to get into the mindset that it was okay to stray from the plan and everything still work out. I really wanted him to understand that these could only perform like the illustration, if THEY paid as illustrated. I also harped on him to setting the expectation in the kids(Especially the 19YO) minds now that they are expected to take this over and start contributing to their retirement no later than age 30.

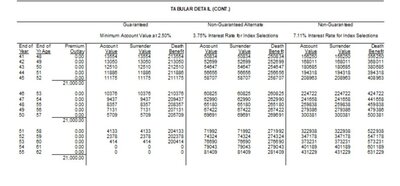

I did just re-run the illustration for the 7yo, assuming he never takes over and all premiums stop with Dad after 15 years. I've attached what that looks like. I think its a pretty good worst case. What do you guys think?

Sorry, Forgot to ask if Waiver of Premium included? These all seem to be very dependent on larger premiums. Disability would change those plans.

None of this is to tear apart plans. We are just asking questions.

Honestly, I didn't even think about WOP. Definitely something I should have, in considering all possible scenarios. You have no idea how much I appreciate your questions and feedback. This is exactly what I wanted! I feel like my IMO didn't ask enough questions when helping me build this. They were more like "Build it however you want. Anything is better than what they have now!".....