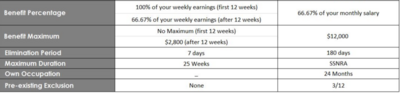

I attached a breakdown of my employer's STD and LTD plans. I'm currently on STD, month 3.

For STD, it appears after the first 3 months of STD I'd get a max of $2800 per week for the next 3 months. Is that right, and am I correct that the $2800 is taxable?

For LTD, is the $12k benefit max meaning you can't receive more than $12k per month? So if your weekly pay at 100% is $6K is it right that you'd get $12k per month? Is it taxable?

For LTD, what does 24 months own occupation and 3/12 preexisting exclusion? And is max duration 67 years old?

I assume the insurance company evaluates you monthly or quarterly typically to ensure you are compliant and deserving of continuation?

For STD, it appears after the first 3 months of STD I'd get a max of $2800 per week for the next 3 months. Is that right, and am I correct that the $2800 is taxable?

For LTD, is the $12k benefit max meaning you can't receive more than $12k per month? So if your weekly pay at 100% is $6K is it right that you'd get $12k per month? Is it taxable?

For LTD, what does 24 months own occupation and 3/12 preexisting exclusion? And is max duration 67 years old?

I assume the insurance company evaluates you monthly or quarterly typically to ensure you are compliant and deserving of continuation?