Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Help with a Key Man policy

- Thread starter nstok22

- Start date

- 11,275

- Thread starter

- #3

- 5,290

Not deductible, unless you want the proceeds to be taxable.

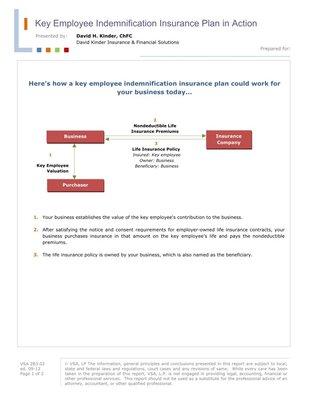

View attachment 5251

Is it proceeds if he's just getting his premiums back?

Yes because you didn't pay taxes on the premiums, so you pay ordinary income tax when they're returned to you.

- 10,325

The ROP portion is received tax-free assuming the premium was not deducted.

If the business did not deduct premiums, it means the premiums were already included in taxable income.

But as DHK posted, if Premiums are deducted, the DB will be taxable.

If the business did not deduct premiums, it means the premiums were already included in taxable income.

But as DHK posted, if Premiums are deducted, the DB will be taxable.

Last edited:

The Benefit Coach

Expert

- 37

Not deductible at all.

I think you guys are confusing this with the way the IRS handles deductions for D.I.

I think you guys are confusing this with the way the IRS handles deductions for D.I.

Similar threads

- Replies

- 7

- Views

- 884

- Replies

- 5

- Views

- 435

- Replies

- 12

- Views

- 1K