Waterfall9856

New Member

- 6

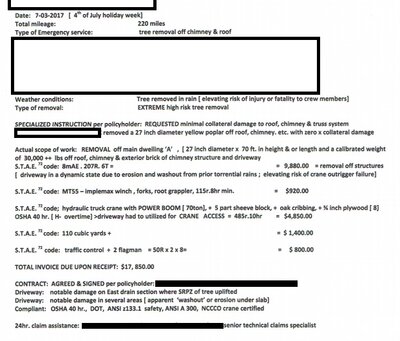

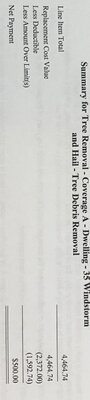

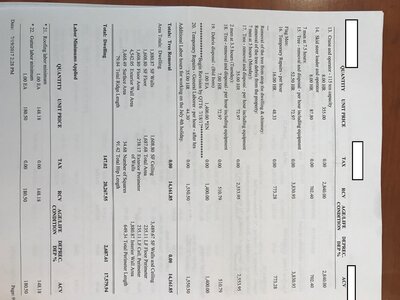

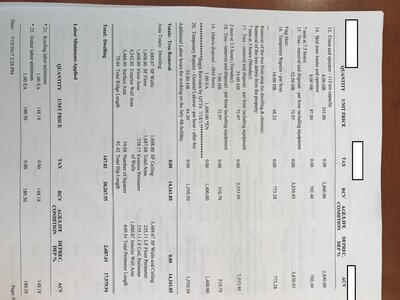

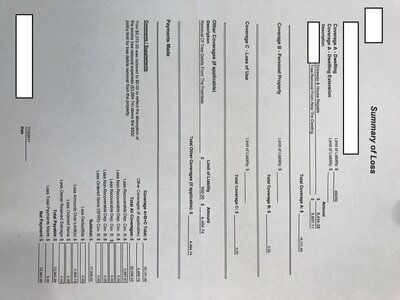

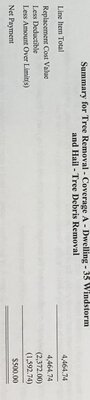

Need help please. A tree fell on our home, I reported the claim and was told to remove the tree from my house and it was my responsibility as the policyholder to protect the home and minimize damage. I removed the tree and now the insurance company is saying that the invoice for the tree removal is too high and they will only pay a “reasonable” amount.

There have been many disagreements between the adjuster and the contractor, reassignment of a new adjuster, blame placed on me by the adjuster for not getting multiple estimates when I was told by the insurance company to get the tree off my house and save any receipts. It was on July 4th weekend and it was raining and I was worried about roof and water damage. This was the only contractor that answered his phone on a Sunday of a holiday week (looking back, I am sure he took advantage of me).

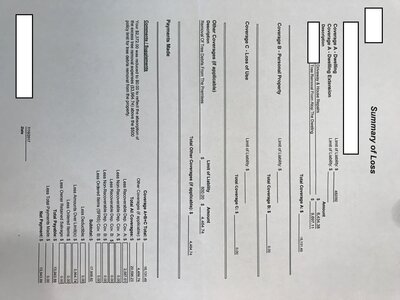

Do I try and get more help in coverage from the insurance company? The contractor already reduced the invoice to help me I have since paid the tree contractor and now understand that was a mistake (and that’s another story with bad information by the adjuster). But there is still the difference of $6,994 that I have paid vs what the insurance wants to reimburse me.

I feel like I was misled by the insurance company telling me to get the tree removed and putting the pressure of responsibility on me to secure the house but now holding me responsible that I should have known the contractor’s price was high?? I’ve never been in this situation before and everything the tree contractor explained to me about emergency service, needing a crane, minimizing damage to the chimney in removing the tree, etc seemed reasonable to me as a homeowner so I went ahead with the removal.

I would appreciate any guidance on my rights that I should be aware of as a policy holder. I feel like I have hit a wall in the negotiation process and I’m not sure if I should hire and attorney, get a public adjuster, ask for mediation, etc.

Thanks for any insight.

There have been many disagreements between the adjuster and the contractor, reassignment of a new adjuster, blame placed on me by the adjuster for not getting multiple estimates when I was told by the insurance company to get the tree off my house and save any receipts. It was on July 4th weekend and it was raining and I was worried about roof and water damage. This was the only contractor that answered his phone on a Sunday of a holiday week (looking back, I am sure he took advantage of me).

Do I try and get more help in coverage from the insurance company? The contractor already reduced the invoice to help me I have since paid the tree contractor and now understand that was a mistake (and that’s another story with bad information by the adjuster). But there is still the difference of $6,994 that I have paid vs what the insurance wants to reimburse me.

I feel like I was misled by the insurance company telling me to get the tree removed and putting the pressure of responsibility on me to secure the house but now holding me responsible that I should have known the contractor’s price was high?? I’ve never been in this situation before and everything the tree contractor explained to me about emergency service, needing a crane, minimizing damage to the chimney in removing the tree, etc seemed reasonable to me as a homeowner so I went ahead with the removal.

I would appreciate any guidance on my rights that I should be aware of as a policy holder. I feel like I have hit a wall in the negotiation process and I’m not sure if I should hire and attorney, get a public adjuster, ask for mediation, etc.

Thanks for any insight.

Sorry for the long post.

Sorry for the long post.