Jason Venecio

New Member

- 2

Hello. I'm a new IUL agent and I'm still trying to learn how IUL functions.

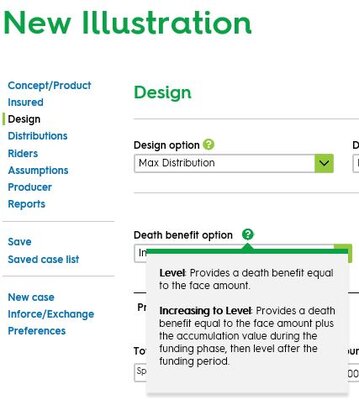

My questions is, when a client starts taking income distributions at a certain age, if their death benefit is set up as INCREASING, does it automatically switch to LEVEL? I seem to have noticed this on the illustrations.

I appreciate your responses.

My questions is, when a client starts taking income distributions at a certain age, if their death benefit is set up as INCREASING, does it automatically switch to LEVEL? I seem to have noticed this on the illustrations.

I appreciate your responses.