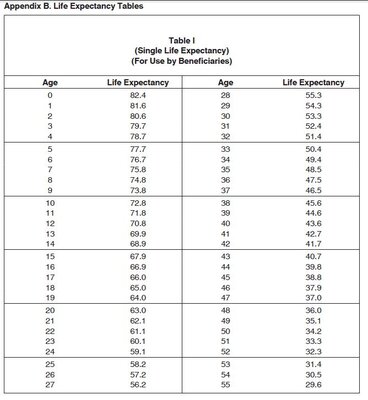

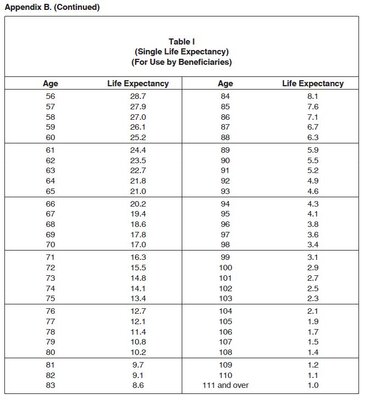

I have a client that is the beneficiary of her deceased mothers annuity. It is non qualified money. She is wanting to take out her own annuity with the proceeds but the company says if she rolls it into a new contract she will have to pay RMD the first year. It's about $208,000 give or take and the new annuitant is 6 years old.

Does anyone a an idea of what the RMD would be and what is the best way to avoid paying taxes on the proceeds now?

Does anyone a an idea of what the RMD would be and what is the best way to avoid paying taxes on the proceeds now?