Hi everyone,

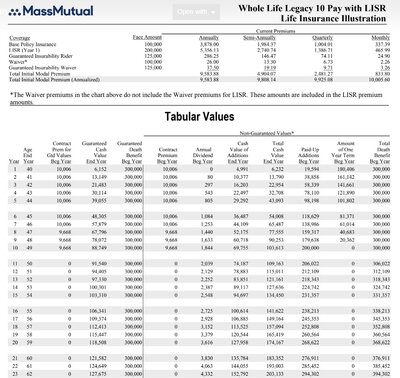

I'm looking into buying WL policy with the goals of cash accumulation, extra cash dump in early years and the ability to deposit more even when the policy is paid up after 10 years. I asked my agent to design such policy that BNTRS usually described on here, blended 10-pay WL + term + PUA, and my agent came back with the attached illustration and told me that this is the best policy he can do. And he mentioned that I can not deposit more cash into this policy after year 10 to avoid MEC. As you can see, this policy takes about 13 years to break even with the guaranteed cash value.

Just wonder if this is a good designed policy to move forward closing the deal with him?

Thanks

I'm looking into buying WL policy with the goals of cash accumulation, extra cash dump in early years and the ability to deposit more even when the policy is paid up after 10 years. I asked my agent to design such policy that BNTRS usually described on here, blended 10-pay WL + term + PUA, and my agent came back with the attached illustration and told me that this is the best policy he can do. And he mentioned that I can not deposit more cash into this policy after year 10 to avoid MEC. As you can see, this policy takes about 13 years to break even with the guaranteed cash value.

Just wonder if this is a good designed policy to move forward closing the deal with him?

Thanks