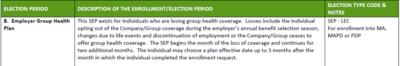

Coming off employer coverage...

You get an 8-month SEP for enrolling in Medicare.

You get the 6-month OEP for MedSupp , that starts When Part B starts.

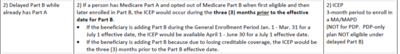

For MAPD... during the ICEP, you only get 3 months that take place before Part B begins, which is odd.

So... someone would have to sign up for MAPD first, then Medicare?

What are the specifics of how that works?

You get an 8-month SEP for enrolling in Medicare.

You get the 6-month OEP for MedSupp , that starts When Part B starts.

For MAPD... during the ICEP, you only get 3 months that take place before Part B begins, which is odd.

So... someone would have to sign up for MAPD first, then Medicare?

What are the specifics of how that works?