Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Masterdex 10 rollover to roth ira

- Thread starter BUCKEYE

- Start date

- 11,271

Only if it was a Roth IRA masterdex 10 annuity. Otherwise, it'll be a distribution from the annuity (possibly taxable/penalty depending on age) and then a contribution to a new Roth IRA subject to annual limits.

You may find this helpful:

https://www.irs.gov/pub/irs-tege/rollover_chart.pdf

You may find this helpful:

https://www.irs.gov/pub/irs-tege/rollover_chart.pdf

CubbieBlue

New Member

- 1

Buckeye,

M

I just came across your post and my wife is in EXACTLY the same situation as your client.

After spending the last 12 years believing she was in a Roth IRA, as she was told by her broker, we now realize that she is actually in this Allianz Masterdex 10 annuity within a Roth IRA.

Did you have success in extricating your client from this terrible product?

If so, please share your results.

Thank you in advance!

M

I just came across your post and my wife is in EXACTLY the same situation as your client.

After spending the last 12 years believing she was in a Roth IRA, as she was told by her broker, we now realize that she is actually in this Allianz Masterdex 10 annuity within a Roth IRA.

Did you have success in extricating your client from this terrible product?

If so, please share your results.

Thank you in advance!

- 10,318

Buckeye,

M

I just came across your post and my wife is in EXACTLY the same situation as your client.

After spending the last 12 years believing she was in a Roth IRA, as she was told by her broker, we now realize that she is actually in this Allianz Masterdex 10 annuity within a Roth IRA.

Did you have success in extricating your client from this terrible product?

If so, please share your results.

Thank you in advance!

Most Masterdex statements Ive seen show strong returns, much higher than most other fixed investments with the same risk profile. (meaning no risk of loss)

The drawback (and what most consumers hate, and why I never sold the product) is that it is essentially a 15 year surrender period.

If I remember correctly, you can take distributions beginning year 10. But you must take them over a minimum of 5 years.

Not much you can do at this point other than begin distributions. You can do a Tax-Free Transfer of Funds yearly to the investment product you prefer (mutual funds, ETFs, CDs, better annuities, etc).

FYI, not all indexed annuities lock up your money like that one does. There are products with just a 5 or 7 year surrender period, and allow a lump sum withdrawal after that period.

Also, a "Roth IRA" is nothing but a tax classification that is assigned to an Investment Product of some sort. Every "Roth IRA" has to be funded by some type of investment product... annuities are a very common choice, so are mutual funds, etfs, CDs, Bonds, etc. Your wife is in a Roth IRA, its just funded by an Annuity rather than a different investment product. She is free to transfer to a different Roth IRA funded by a different investment product... she just is subject to the contract terms for her current investment... no different than if she was in B Class Mutual Funds that had a Contingent Deferred Sales Charge.

The product certainly could have been misrepresented to your wife. But for her to not know she bought an annuity; the agent would have had to completely lie about everything, AND your wife would have had to not read a single thing on the multiple forms she signed.

Last edited:

- 4,550

Hi I am a newer agent and one of my clients wants to know if they can convert their masterdex 10 annuity to a roth ira in a different company? I cant find information on it. Thanks for helping.

Consult CPA 1st. I have seen way to many people in average tax brackets now, who will be in the same or lower tax brackets in retirement make the mistake to convert traditional IRA money to Roth.

Think of all the people that converted in the late 1990a. Not only did they get taxed on a high account value at the time that later shrunk when the market tanked, but many of those same people are now retired and in lower tax brackets as the tax rates for lowered this year.

So, not everyone should convert. There is analysis that should be done. This is all in addition to making sure the product the money is currently in as a Traditional IRA doesn't have heavy surrender charge or a lengthy surrender charge schedule.

An ideal strategy in my mind is to convert traditional to Roth right after retirement. Of you can live a few years on after tax money or life insurance distributions, you can keep yourself in the 0 or 10% tax bracket & convert gradually over a few years. Have helped people in the past that take a few years off for sabbatical or mission trip convert during these years they have little or no earned income

- 11,271

I have seen way to many people in average tax brackets now, who will be in the same or lower tax brackets in retirement make the mistake to convert traditional IRA money to Roth.

I'm not sure I'd be making that assumption:

- 4,550

I'm not sure I'd be making that assumption:

Completely agree. The cases in an talking about were people in early to mid 60s where 1 spouse was making 50k & other retired. They converted their only 50k to 100k to their name & would be living almost completely on SS in retirement. Those types of clients are in the 0% tax bracket as seniors & could pull 20-25k per year from traditional IRA accounts that are wiped away by standard deductions.

Dropping 50k To 100k on top of other income while still working puts almost all of it in the 22% federal tax rate. It happens more than you think when people get too excited about a Roth without doing all the math.

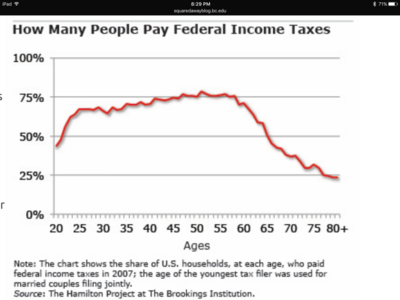

Pull up the stats on over age 65 tax brackets. I think you will be shocked at how many don't even have to file a tax return any longer as their taxable income is below the standard deductions. This is one of the main reasons Mitt Romney's statement that 47% of people don't pay federal taxes. A large majority are seniors who either have no income other than SS or can control their income with ownership of Annuities or limit IRA WD to RMD

- 11,271

Those types of clients are in the 0% tax bracket as seniors & could pull 20-25k per year from traditional IRA accounts that are wiped away by standard deductions.

But if they put that money into life insurance (assuming they qualify) - they could have chronic illness riders and pass on that higher death benefit income-tax free to beneficiaries.

- 4,550

But if they put that money into life insurance (assuming they qualify) - they could have chronic illness riders and pass on that higher death benefit income-tax free to beneficiaries.

Absolutely. Most of our industry puts a ton of seniors in NQ Annuities blindly where that money would be much, much better served in SPWL or premium paying life. There are billions sitting in NQ Annuity contracts deferring taxes each year at 0% just building up gains that will many times be taxed all at one time when the beneficiaries who may be in higher tax brakets receive the gains all in 1 year. While most bene could spread the tax out by using 5 year deferral or even SPIA payout, too many agents in our industry either dont know how to help those individuals at death claim time or want to make a big new sale with the new found lump sum. Regardless, many of those lazy dollars going into NQ Annuity that are not being used to live on would be much better served in Life contracts for all the reasons you state.

Attached is a graphic showing how few of seniors pay any federal income tax & many that do pay some federal taxes are many times in the lowest brackets. I dont see politicians messing with their voting block

- 11,271

I expanded a lot of my knowledge in this area through Van Mueller. It really helps to separate those who just sell products and those who find more optimal solutions.

Attachments

-

Van Mueller - Economic Conversation Part 1.PDF502 KB · Views: 0

-

Van Mueller - Make IRS website your friend.PDF481.7 KB · Views: 1

-

Van Mueller - The power of asking the right questions.pdf310.3 KB · Views: 0

-

Van Mueller - the “Greatest Time Ever to Sell Life Insurance” – NAIFA.pdf390.1 KB · Views: 1

-

Tax Planning is vital for retiree financial success - Van Mueller.PDF495.9 KB · Views: 0

Similar threads

- Replies

- 32

- Views

- 4K

- Replies

- 5

- Views

- 730

- Replies

- 8

- Views

- 523

- Replies

- 8

- Views

- 690