- 456

Insurance Forums Staff submitted a new article

MYGA sales growth dominates among deferred annuities in 1Q 2022, Wink report finds

MYGA sales growth dominates among deferred annuities in 1Q 2022, Wink report finds

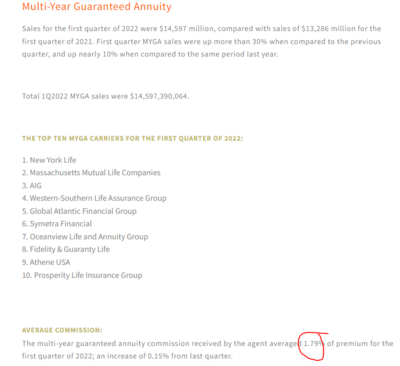

Continue reading the Original Article.Latest sales report shows a 2.2% increase over 1Q 2021 deferred annuity sales.