- 11,265

I've been doing a bit of internet research on various company's premium to income ratios... and perhaps how it directs their agents in how and when to present permanent life insurance.

I was quite surprised with the low ratios allowed by MassMutual without requiring further explanation by their underwriting department. Granted, it was a 2008 underwriting guide... but I doubt they changed much in the last few years.

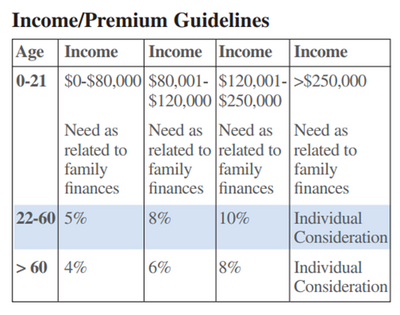

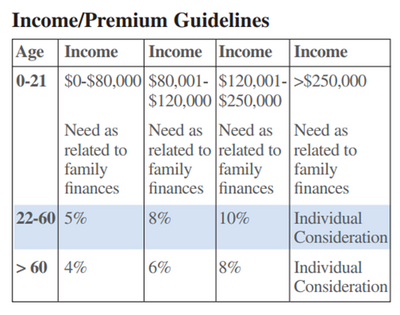

Almost everybody else I've found... have FAR higher premium to income ratios allowed. I've attached Penn Mutual, Principal, Met Life / Brighthouse, Lincoln Financial Group, and Midland/NA.

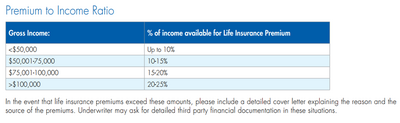

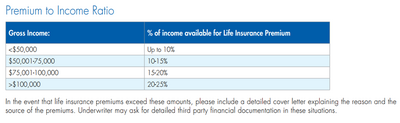

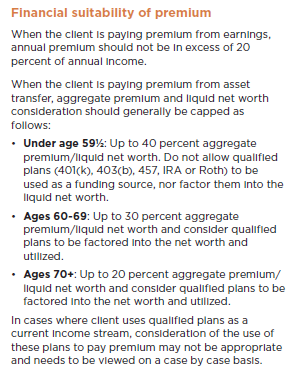

This one is from American National:

I would be curious to see limits from New York Life, Northwestern Mutual, and others.

I was quite surprised with the low ratios allowed by MassMutual without requiring further explanation by their underwriting department. Granted, it was a 2008 underwriting guide... but I doubt they changed much in the last few years.

Almost everybody else I've found... have FAR higher premium to income ratios allowed. I've attached Penn Mutual, Principal, Met Life / Brighthouse, Lincoln Financial Group, and Midland/NA.

This one is from American National:

I would be curious to see limits from New York Life, Northwestern Mutual, and others.

... have I been in the FE business to long?

... have I been in the FE business to long?