To say that UHC Aarp plays the chess game and MoO didn’t start it is just laughable. I know in most states UHC isn’t close to the cheapest, but in fl it is. But what I do know is that they don’t change every two years to a new name. I’ve only been in the biz for 9 years but in those 9 years it’s only been called UHC Aarp.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Rising Costs of Med Supps for the Elderly

- Thread starter Northeast Agent

- Start date

- 6,455

- 6,455

Thanks.Great new avatar

- 29,467

You're correct. I was thinking they used Prudential when I 1st started, but it was Colonial Penn, then Prudential, and now UHC. That's 3 companies in 60 years, and AARP is NOT an insurance company...they're an insurance marketing organization. No shell game.To say that UHC Aarp plays the chess game and MoO didn’t start it is just laughable. I know in most states UHC isn’t close to the cheapest, but in fl it is. But what I do know is that they don’t change every two years to a new name. I’ve only been in the biz for 9 years but in those 9 years it’s only been called UHC Aarp.

"According to the group's official history, Dr. Ethel Percy Andrus founded AARP in 1958. AARP evolved from the National Retired Teachers Association (NRTA), which Andrus had established in 1947 to promote her philosophy of productive aging, and to promote health insurance for retired teachers. After ten years, she opened the organization to all Americans over 50, creating AARP.[8] Today, the NRTA is a division within AARP.[9]

Critics of AARP offer an alternative version of the group's origins. 60 Minutes reported in a 1978 exposé that AARP had been established as a marketing device by Leonard Davis, founder of the Colonial Penn Group insurance companies, after he met Ethel Percy Andrus.[10] According to critics, until the 1980s AARP was controlled by Davis, who promoted its image as a non-profit advocate of retirees in order to sell insurance to members.[11] Possibly as a result of this report, AARP conducted a competitive bidding process, and, in 1980, shifted the insurance contracts available to members to Prudential Financial.[12]

In the 1990s, the United States Senate investigated AARP's non-profit status, with Republican Senator Alan K. Simpson, then chairman of the United States Senate Finance Subcommittee on Social Security, Pensions, and Family Policy, questioning the organization's tax-exempt status in congressional hearings. According to Charles Blahous, the investigations did not reveal sufficient evidence to change the organization's status,[13] though in an interview years later by the Des Moines Register, Senator Simpson remained "troubled by AARP's practices", calling AARP "the biggest marketing operation in America and money-maker" and an organization whose practices are "the greatest abuse of American generosity I witnessed in my time in the U.S. Senate"."

- 29,467

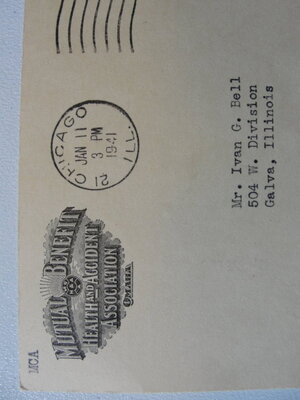

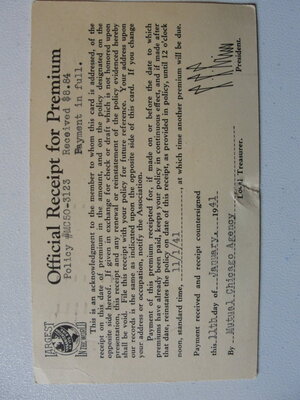

I had to lay down to read that.View attachment 4342 View attachment 4343

Dear Agents,

My insurance keeps going up. What can I do?

Old Buzzard

(Don't know how to make the pictures rotate, sorry.)

they don’t change every two years to a new name. I’ve only been in the biz for 9 years but in those 9 years it’s only been called UHC Aarp.

There is a reason for the marriage. Actually 762,000,000 of them.

There is a reason for the marriage. Actually 762,000,000 of them.

Yeah I’m sure they don’t want to lose that.

Did you read that article though? Holy crap there’s some bad info on there. “The medicare supplement open enrollment that ends dec 7”.

“three companies with equal or better financial-strength ratings from Weiss offer lower premiums for Medicare Plan A policies than UnitedHealthcare,”

“But he said he never heard a response when he wrote to AARP in 2013 about concerns with UnitedHealthcare related to getting a wheelchair his wife Vivian needed. They wound up shopping around and choosing other insurers for health and car, carefully looking at price and other factors that may change year to year.”

XpressInsurance

Super Genius

- 244

The issue I have with UHC-AARP partnership is, AARP says they are looking for seniors best interest, so they recommend only recommend UHC Medicare Supplement plans. Unless your in NY or FL few other states in the NE they are really not competitive. Pushing a standardized policy that cost more is not in the best interest of the senior. I found a article online that in 2013 they received $762M in royalties (they can't pay them commission) per year from the UHC & Auto insurance they push, that appears they have AARP best interest in mind first & foremost.

The issue I have with UHC-AARP partnership is, AARP says they are looking for seniors best interest, so they recommend only recommend UHC Medicare Supplement plans. Unless your in NY or FL few other states in the NE they are really not competitive. Pushing a standardized policy that cost more is not in the best interest of the senior. I found a article online that in 2013 they received $762M in royalties (they can't pay them commission) per year from the UHC & Auto insurance they push, that appears they have AARP best interest in mind first & foremost.

You found an article? Like the one referenced two posts above yours?

- 2,177

Great article. Especially liked the part where the indignant spouse of the Medicare beneficiary dropped AARP and took their med supp business elsewhere to have better success getting her wheelchair covered. I wonder which med supp plan has those magical powers?There is a reason for the marriage. Actually 762,000,000 of them.

Similar threads

- Replies

- 2

- Views

- 696

- Replies

- 0

- Views

- 34

- Replies

- 0

- Views

- 266

- Replies

- 10

- Views

- 2K

- Replies

- 5

- Views

- 293