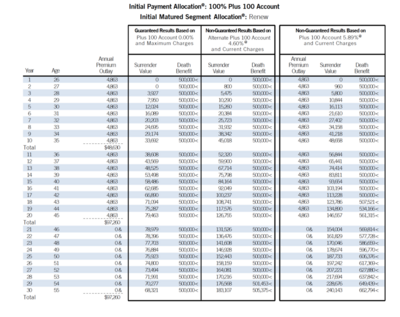

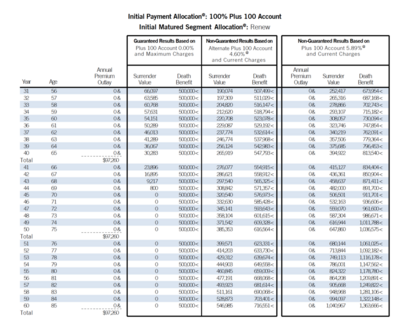

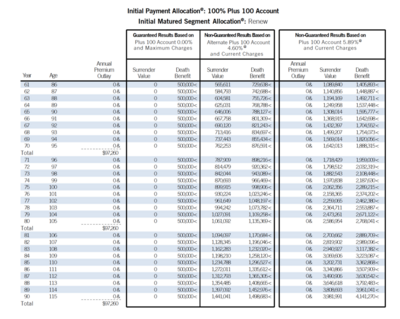

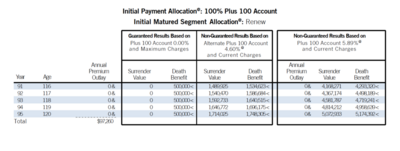

Guaranteed Results Based on Minimum Interest Rate of 1.00% & Maximum Charges

Prudential 500K conversion 20 Pay illustration states the above statement.

and after 20th year, i am not paying anything else. the policy goes up to 120 year.

are there any reasons why one might have to continue to pay even after 20th year?

No, once you pay 20yrs (if it was designed as a 20pay) you are done. And contractually the policy will remain in force until whatever age it was designed to. You do not have to pay anymore after the funding period.

If you are planning to buy a GUL, converting the current policy is probably gonna be the best given current health.