InviewFinancial

Expert

- 27

Hello.

I would like to secure some guaranteed funds for my family but want to make sure GUL is the best policy for me for my needs.

I am at the moment 27 year.

3 years ago I bought 30 Yr Term (1 mil ) with Prudential which used to cost estimate $700 /year

so Total cost for 30 year would have been $21000.

Last year, because i was diagnosed with Rheumatoid Arthritis, we asked my agent for some permanent recommendation.

He recommended converting to GUL so we did.

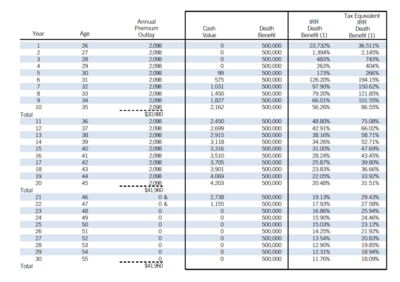

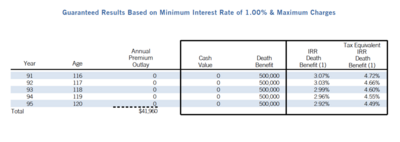

$500K was converted to Prudential GUL which cost $2069 (year) . i did request him that i want to be paid up in 20 year. so total cost of this will be $41380. and return will be $1 mil.. (the policy is up to 120 year or something) . and ofcourse i also didnt care about cash value. because true WHOLE life was same cost for 1/10 of the face value.

Q1) does this GUL Look real? as long as i make my payments for next 20 years on time, if i die any time from now till the year 120.. my family will get paid 1mil.

Q2) are there any new policies i can apply even after being diagnosed with Rheumatoid Arthritis ?

Q3) i am thinking of converting the other $500k term also to GUL. the agent has quotes the $2098 for 20 pay.

and $1498 if i want to pay for rest of my life. what i am curious is .. the 20 pay is only going to cost me close to $41000 ... (return is $500K) but if i choose to pay for rest of my life it will cost me double or triple.. (ie.. at the age of 95 i would have paid 105K)

Q4) basically i want to have 1 mil policy for rest of my life, but want to pay the least for it.. what is best policy for me.

q5) i have also thought about having a whole life policy with cash value, and that policy pay my GUL or other policy after 20 year. so i dont have to worry about making payments.

Thanks

Dipan

I would like to secure some guaranteed funds for my family but want to make sure GUL is the best policy for me for my needs.

I am at the moment 27 year.

3 years ago I bought 30 Yr Term (1 mil ) with Prudential which used to cost estimate $700 /year

so Total cost for 30 year would have been $21000.

Last year, because i was diagnosed with Rheumatoid Arthritis, we asked my agent for some permanent recommendation.

He recommended converting to GUL so we did.

$500K was converted to Prudential GUL which cost $2069 (year) . i did request him that i want to be paid up in 20 year. so total cost of this will be $41380. and return will be $1 mil.. (the policy is up to 120 year or something) . and ofcourse i also didnt care about cash value. because true WHOLE life was same cost for 1/10 of the face value.

Q1) does this GUL Look real? as long as i make my payments for next 20 years on time, if i die any time from now till the year 120.. my family will get paid 1mil.

Q2) are there any new policies i can apply even after being diagnosed with Rheumatoid Arthritis ?

Q3) i am thinking of converting the other $500k term also to GUL. the agent has quotes the $2098 for 20 pay.

and $1498 if i want to pay for rest of my life. what i am curious is .. the 20 pay is only going to cost me close to $41000 ... (return is $500K) but if i choose to pay for rest of my life it will cost me double or triple.. (ie.. at the age of 95 i would have paid 105K)

Q4) basically i want to have 1 mil policy for rest of my life, but want to pay the least for it.. what is best policy for me.

q5) i have also thought about having a whole life policy with cash value, and that policy pay my GUL or other policy after 20 year. so i dont have to worry about making payments.

Thanks

Dipan