- 6,455

Not absolutely sure, but think these are basic details.

So there is an employer retirement plan (I think 403(b)) with a major US financial organization.

Plan holder dies, funds are held in a trust in some manner.

Trust has multiple beneficiaries.

One of the beneficiaries is also estate executor and trust administrator.

His financial advisor is now talking about creating Inherited IRAs.

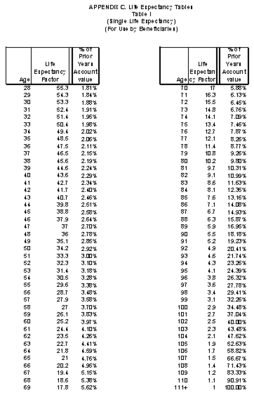

After doing some brief scanning of generally available information, it appears the most desirable situation for a beneficiary is an IRA of the life expectancy or "stretch" persuasion.

Are there other "hard issues", technicalities or traps a beneficiary should be aware of in discussing this situation with the executor/administrator and the financial advisor?

So there is an employer retirement plan (I think 403(b)) with a major US financial organization.

Plan holder dies, funds are held in a trust in some manner.

Trust has multiple beneficiaries.

One of the beneficiaries is also estate executor and trust administrator.

His financial advisor is now talking about creating Inherited IRAs.

After doing some brief scanning of generally available information, it appears the most desirable situation for a beneficiary is an IRA of the life expectancy or "stretch" persuasion.

Are there other "hard issues", technicalities or traps a beneficiary should be aware of in discussing this situation with the executor/administrator and the financial advisor?