Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

UHC Med-Supps Florida Ridiculous News

- Thread starter Russ

- Start date

I write a lot of T65’s with them now, but back when their underwriting was more generous I wrote older people.

Their rates for a male age 65 in the panhandle is among the best. Humana is an alternative but they take months to pay an OE case. Plus they lose apps. Their response isn’t adequate either.

And we have zero idea of their rate history. Up until 1/1/18 they were among the highest rates

Good info Chaz. Does this make a move to plan G for current uhc clients a bigger savings if 65-69?

I did a t65 this week plan G smoker. About $32 less per month than an F

joe92275

Super Genius

- 165

T65 in orlando here. That’s plan F and btw starting in feb plan G is the cheapest too

for an extra $3-$10 a month I will show value with the other carriers. I will also ask them to google the Federal lawsuit pending against them. That pretty much seals the deal and they want nothing to do with anything connected to them.

for an extra $3-$10 a month I will show value with the other carriers. I will also ask them to google the Federal lawsuit pending against them. That pretty much seals the deal and they want nothing to do with anything connected to them.

Ahh you’re one of those agents.

It’s pretty unethical in my opinion. If you take the time to look up rates for the last 15 years, you’ll see that you are screwing your clients. Every other company plays the “shell game”. I’ve had clients since 2009 that have never had to shop their med supp. I guess it does put more money in my pocket in the end if I put them with another company.

I’m assuming you’ll put them with MoO or Humana?

policywunk

Guru

- 542

I didn’t read it that way. It says you retain the age that you purchased it at. So, if you purchased at age 65, you stay in the 65 age rate group. No increase on plan F, decrease 7.9% on G etc.

If you want an effective date of 2/1/19 and you are 69 years old, you will pay (that shown % more) than a 65 year old.

It’s actually a good thing. Uhc in the past had age brackets (65, 66-69, 70-74 etc) and they are just going year by year now. But your current clients will not have an increase.

What I can not get a straight answer on when I call PHD is what happens to the rates if we enroll them for 12/1 or 1/1/18 if they are lets say 69.I know they do not have a 12 month rate guarantee but would they possibly be grandfathered in under the current 66-69 age band rates?

If they enrolled at age 69, they will get the 69 year old rate (and increase). There is no rate guarantee in FL. The previous age bands are no longer, instead they have individual age bands based on the age they enrolled at (therefore there is no grandfathering)What I can not get a straight answer on when I call PHD is what happens to the rates if we enroll them for 12/1 or 1/1/18 if they are lets say 69.I know they do not have a 12 month rate guarantee but would they possibly be grandfathered in under the current 66-69 age band rates?

joe92275

Super Genius

- 165

Ahh you’re one of those agents.

It’s pretty unethical in my opinion. If you take the time to look up rates for the last 15 years, you’ll see that you are screwing your clients. Every other company plays the “shell game”. I’ve had clients since 2009 that have never had to shop their med supp. I guess it does put more money in my pocket in the end if I put them with another company.

I’m assuming you’ll put them with MoO or Humana?

We write mostly south Florida (in FL) so United American wins 97% of the time. Humana does come up competitive but why send a client out there with a card that has the name of a carrier that doctor offices post signs they do not accept? I know, I know it's a supp...everyone has to take it....but why cause confusion?

And I just pulled rates for Orlando....Female age 70 NS AARP/UHC: Plan G $216.25 and our lowest offering.....Plan G $177.99. That's a $459.12 annual swing. For what? So no, I am not "one of those agents". As we tell clients...if rates get out of control, you will always have UHC because they take anybody breathing. Ha!!

And I just pulled rates for Orlando....Female age 70 NS AARP/UHC: Plan G $216.25 and our lowest offering.....Plan G $177.99. That's a $459.12 annual swing. For what? So no, I am not "one of those agents". As we tell clients...if rates get out of control, you will always have UHC because they take anybody breathing. Ha!!

You might want to update your quoting program.

United American is $227 for plan G Female NS in 32801.

Uhc is $196.98.

In this case I would write Humana anyways. $186.38.

For real though, what quoting tool are you using?

Also, you might want to rethink your strategy when telling clients uhc will take anyone. You obviously haven’t looked at the app in a couple of years. They are much more strict now. Two year look back on heart attack, stroke, cancer (including melanoma), artery vein blockage, cardiomyopathy, pvd, CAD, COPD, cirrhosis, etc.

And I’m not knocking United American. If they are continually the lowest or right around there year after year, I would write them too. But you said earlier that you have to bash uhc to convince people to buy UA when they could save money.

joe92275

Super Genius

- 165

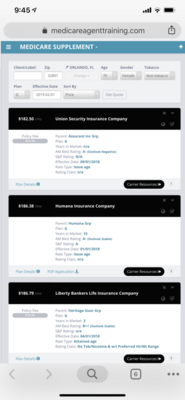

View attachment 4999

You might want to update your quoting program.

United American is $227 for plan G Female NS in 32801.

Uhc is $196.98.

In this case I would write Humana anyways. $186.38.

For real though, what quoting tool are you using?

Also, you might want to rethink your strategy when telling clients uhc will take anyone. You obviously haven’t looked at the app in a couple of years. They are much more strict now. Two year look back on heart attack, stroke, cancer (including melanoma), artery vein blockage, cardiomyopathy, pvd, CAD, COPD, cirrhosis, etc.

And I’m not knocking United American. If they are continually the lowest or right around there year after year, I would write them too. But you said earlier that you have to bash uhc to convince people to buy UA when they could save money.

FROM CSG........Zip 32789 Female NS Age 70 Plan G:

$177.99 /mo

Everest Reinsurance Company

$186.38 /mo

Humana Insurance Company

$187.84 /mo

United Of Omaha Life Insurance Company

$188.17 /mo

Americo Financial Life And Annuity Insurance Company

$193.42 /mo

Aetna Health And Life Insurance Company

$193.76 /mo

Pan-American Life Insurance Company

$195.18 /mo

American Retirement Life Insurance Company (Cigna)

$216.25 /mo

AARP Medicare Supplement Plans, Insured By Unitedhealthcare

Similar threads

- Replies

- 2

- Views

- 699

- Replies

- 1

- Views

- 371