A record-high number of American adults (42%) — representing 102 million people — say they need (or need more) life insurance, finds the 2024 Insurance Barometer Study, conducted jointly by nonprofit industry trade associations LIMRA and Life Happens.

While the day-to-day impact of COVID-19 has diminished for most Americans, the heightened awareness about mortality and the importance of life insurance remains. Importantly, the study found 37% of consumers say they intend to purchase coverage within the next 12 months.

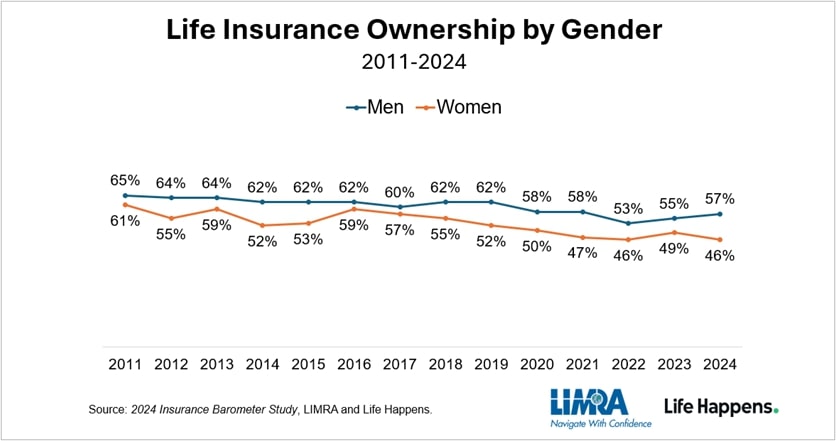

U.S. life insurance ownership has remained relatively steady since 2021, with about half of adults reporting having coverage. The new study, now in its 14th year, reveals middle-income Americans (those with a household income of $50,000 – $149,999) represent the largest market opportunity for the industry. Four in 10 middle-income Americans, or 50 million adults, acknowledge they live with a life insurance coverage gap. This group also expressed a greater intent to buy life insurance (54%) than the general population.

“Engaging the middle market continues to be a high priority for life insurers. These households are more likely to own life insurance (55%) and more likely to recognize the important role life insurance plays in their family’s financial security,” said John Carroll, senior vice president, head of Life & Annuities, LIMRA and LOMA. “Yet, like other consumers, they have little understanding about what and how much life insurance they should buy or how much it actually costs. This leads to indecision and inaction.”

Many take ‘wild guess’ at cost

The No. 1 reason consumers give for not purchasing life insurance — or more of it — is that it’s too expensive. Yet, since the first annual study was conducted in 2011, consumers have consistently overestimated the cost of life insurance. The most recent study shows about three-quarters (72%) of Americans overestimate the true cost of a basic term life insurance policy.

Younger Americans are likely to think it is three times its actual cost. There are few other products on the market today that consumers overestimate the cost by such a wide margin.

When asked how people come up with their life insurance cost estimate, more than half (54%) said it was based on “gut instinct” or a “wild guess.”

“With the need-gap for life insurance, is a knowledge gap — 44% of people admit being only somewhat or not knowledgeable at all about life insurance. And we know people aren’t going to buy what they don’t understand or think they can’t afford,” said Life Happens Executive Director Brian Steiner. “The good news is that 6 in 10 people are using social media for financial and insurance information. And a key commitment for Life Happens has been meeting consumers where they’re at — on social media.”

Bridging the gender gap

In 2024, women were less likely than men (46% vs. 57%) to report having life insurance. This 11-point difference is the largest it has ever been over the 14 years of the study. This is not due to lack of awareness about their need for life insurance. Forty-five percent, or 54 million women, say they live with a coverage gap and more than a third (36%) — and nearly half of younger women — say they plan to purchase life insurance in 2024.

However, half of the women surveyed (50%) noted cost as a deterrent to purchasing life insurance and were less likely to say they are knowledgeable about life insurance (21%).

Moving these individuals from intent to action will require the industry to show how affordable and accessible life insurance can be while demonstrating how life insurance can address many of their financial concerns — from having enough money saved for retirement or building an emergency fund to protecting their dependents from financial hardship or the burden of paying final expenses.

“Year after year, our studies suggest consumers recognize the value of life insurance and — since the pandemic — more people have expressed greater interest in getting coverage,” noted Carroll. “Our industry needs to continue its efforts to leverage digital tools and platforms to make it easier for people to learn about and buy life insurance so they can achieve financial security for themselves and their loved ones.” For additional findings from the 2024 Insurance Barometer Study, visit the Securing the Future Infographic.