I recently had a wide-ranging discussion with a couple of leading universal life producers, who shed some light on how UL can provide tailored solutions for a variety of purposes.

While the first part of our conversation covered topics such as current noteworthy UL product developments, uses for different types of UL products, and how they think UL products can be approved (read Part I here), the second part of the conversation focuses on how they determine what type of UL product makes sense for what type of client, when to use UL instead of whole life or term, and how they structure UL presentations to clients.

Producers R. J. Kelly, CLU, ChFC, IAR, MSFS, founder & chief visionary officer at the Wealth Legacy Family of Companies in San Diego, and Matthew E. Schiff, CLU, president, Schiff Benefits Group, Bala Cynwyd, Pa., always kept the spotlight on the practical aspects of serving their clients.

What type of UL for what type of client?

With regard to the buying decision itself, I directed a question for Kelly and Schiff to the practical aspects of that decision. How do you determine which kind of UL product makes the most sense for which kind of client? Does it have to do with the client’s level of affluence, risk tolerance, need to maximize coverage, or some other factors?

Kelly answered, “Since most of my business owner clients are risk-takers, the EIUL approach makes the most sense to them if they are going to buy permanent. Almost always, a UL chassis makes the most sense because of the flexibility of premiums as needed.”

For Schiff, there are additional considerations. “We choose a VUL product when the client needs flexible premiums, large death benefits, multiple lives to be insured, and the owners and insureds understand the risks and benefits associated with it,” he told me. “Depending on the number of lives, we can also get guaranteed issue.”

When to go with UL over WL or term

Understanding that UL is one of many options, I asked Schiff and Kelly to talk about when they believe UL makes more sense for a client than either whole life or term insurance. Schiff explained, “UL makes great sense when you need permanent coverage and are not sure about your cash flow, but its guarantees are limited in comparison to a whole life contract. And if the insurance need is only temporary, then term makes more sense.”

For Kelly, flexibility is a key factor. “Whole life is just too inflexible. I rarely find an independent agent or broker who can write any product who is choosing to write whole life. I sometimes find it being ‘pushed’ by agents from career shops who get their bread buttered by selling whole life. For those outside the traditional agency system, and who are not using the ‘life insurance as a bank’ approach, I find UL being written, and often EIUL.”

Kelly continued, “Term fits in so many situations – especially where we are trying to put into place a number of coverages to adequately insure the business owner or professional. (e.g., disability, long-term care, etc.). It falls apart long term, however. One wise agent once said, ‘Buying term insurance is like peeing in your pants on a brutally cold day; it feels good at first.’ That’s a bit ‘earthy,’ I know, but it makes the point. Term is meant as a temporary fix, and it is more important to get the amount of coverage that is needed to replace the insured in the event of death, rather than putting all the premium into a permanent contract that may be underfunding the risk situation.”

Effective UL presentation strategies

Presenting the right product in the right situation is no doubt crucial, but so is presenting the product in the most effective manner. I asked Kelly and Schiff whether they’d be willing to share a good, effective presentation that they’ve used recently in showing a client both why UL can be an effective solution to their problem and how UL works. Mr. Kelly told me, “I talk about UL as a ‘Super Roth.’ Most of my clients make too much money to have a Roth, and yet they really like the appeal of it. With a properly designed contract, we can design a ‘Super Roth’ to fund without the $5,500/$6,500 limitation or the requirement of holding the money for five years or to age 59½.”

For Mr. Schiff, it’s all part of a bigger plan. “Since we primarily focus on UL (or VUL) in deferred compensation plans, the best way for us to present the product is as part of the overall benefit funding proposal or model – cash flow, accounting, benefit cash flow, and benefit cost recovery. I’ve never found that an 18- to 22-page illustration is an effective sales tool. Yes, it is necessary, but hardly easy for the client to understand and doesn’t provide “why” someone is purchasing it.”

UL “nuances”

As we wrapped up, I sort of “opened the floor” to any other comments. Schiff took the opportunity to point out some of the nuances of UL in his market. “Our company is unique and usually provides insurance in a corporate scenario. While IUL has its place, it has not been a product that we lead with because of the moving parts inside the product that can be controlled by the issuing home office. And since most of our insureds want to make ‘investment’ selections within their proposed plan, a VUL product provides that flexibility that IUL does not.

“In the banking world, though,” he concluded, “a VUL or UL can be an alternative to their current investment portfolio – so long as there is an insurance need on the key executives.”

More about the experts featured in this article:

R.J. Kelly, CLU, ChFC, MSFS, strives to accomplish an ideal outcome for today, tomorrow, and the future, both personally and professionally. His strengths and talents lie in his ability to evaluate challenges and see opportunities that are rewarding, successful, and significant. He is the founder and chief visionary officer of the Wealth Legacy Family of Companies in San Diego, which specializes in tending to the many diverse needs of closely held businesses and professional families. Mr. Kelly develops comprehensive plans that stimulate growth, provide protection, manage legacy issues, and facilitate business succession and exit strategies. He is also the co-founder and chair of The Center for Wealth and Legacy, a non-profit whose main goal is to challenge business leaders to positively impact their community. He is very active in the non-profit community and offers workshops to bring non-profit leaders together to maximize their potential and recognize opportunities for success. Other passions include his devotion to his wife and family, reading, diving, adventure travel, and making a positive difference in his world.

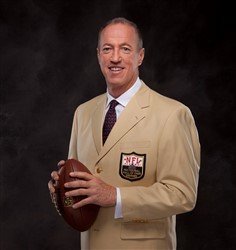

Matthew E. Schiff, CLU, is the president of Schiff Benefits Group, LLC, specializing in the design, implementation, financing, and ongoing administrative support of supplemental executive benefits programs. With more than 23 years of experience in the financial services industry, he is recognized as a leader in the deferred compensation field. Mr. Schiff is a Life Member of the Million Dollar Round Table (MDRT), with 10 Top of the Table distinctions.

Charles K. Hirsch, CLU, is contributing editor of Insurance Forums. He is also the president of Hirsch Communications Consulting, LLC, a communications consulting operation in Florissant, Mo. For many years, Chuck was the editor and publisher of Life Insurance Selling magazine and wrote the monthly column, What’s Going On in the Life Insurance Business. From 1999 to 2008, he was the publisher of several of the leading industry magazines in the life insurance, property/casualty insurance, and mortgage markets. These days, Chuck’s firm specializes in the development and execution of many kinds of communication strategies, particularly in the financial services business.

Also read: In Part I of this interview with R. J. Kelly, CLU, ChFC, IAR, MSFS, and Matthew E. Schiff, CLU, topics include:

• Noteworthy UL product developments

• Different types of UL products

• How UL products can be improved