Universal Life (UL) comes in a wide array of “flavors” these days, offering producers a lot of variety and their clients a lot of flexibility. But in addition to variety within the product category itself, there are producers who use UL to offer varying solutions in varying markets.

I recently talked to a couple of leading UL producers – R. J. Kelly, CLU, ChFC, IAR, MSFS, founder & chief visionary officer at the Wealth Legacy Family of Companies in San Diego, and Matthew E. Schiff, CLU, president, Schiff Benefits Group, Bala Cynwyd, Pa. Our discussion about UL was fairly wide-ranging, from the current “state of the art” in products to the most effective UL presentations in their respective markets. But as you might expect from two top producers, the spotlight was always on the practical aspects of serving their clients.

I started off the conversation by asking whether there was anything about the current UL products that struck them as particularly innovative or noteworthy. Kelly told me, “I really like the ‘multi-index buckets’ that some carriers are providing that give opportunities for ‘non-correlated returns’ – 70% of the highest returning index, 30% of the next highest performing index, 0% of the lowest performing index.”

And continuing along those lines, I asked which of the array of UL products – Indexed Universal Life (IUL), Variable Universal Life (VUL), “traditional” Universal Life, etc. – seemed to best fit their own clients and why. Kelly continued, “Equity Indexed Universal Life (EIUL) and UL fit my clients, which are privately held business owners typically. The flexibility is critically important, as opposed to other forms of permanent coverage. I used to write a significant amount of VUL, but find it to be an expensive chassis to feed in these lower return environments.”

Schiff said, “Today’s Universal Life still provides premium flexibility for the buyers of life insurance who are worried about their cash flow and understand that interest rates, or performance – when considering IUL and VUL – determine whether they will need to pay more in the future to keep their policy in force. That hasn’t changed in 25 years – since interest rates were at 13% to 14% – and in spite of the reduced offerings of Guaranteed Universal Life, can provide tremendous protection for a fraction of whole life. That said, it should be sold to the ‘sophisticated’ buyer who needs – or wants – these features and has some risk affinity.

“In my business, which is primarily corporate and bank owned life insurance – COLI and BOLI – banks buy a single premium modified endowment contract – MEC – that currently credits a cash return that exceeds what they would be able to get – after taxes – in an alternative product such as a mortgage backed security or consumer loans,” Schiff said. “Since the product is interest sensitive, it will fluctuate similarly to their current portfolio and the buyer – that is, the bank executive – is comfortable with a ‘traditional’ return.”

And what about corporations? “Corporations, however, are totally different,” Schiff said. “Many times they buy an insurance product to provide key man coverage and want any of the following – all, if possible, at the same time: guaranteed rates of return, flexible premiums, tax deferred accumulation – market or interest sensitive returns – and simplified or guaranteed issue. Unfortunately, to get one feature, the client may have to give up another.

“In our discussions with clients, while IUL provides ‘downside’ protection to the owner, many times they have felt that they give up too much – that is, upside potential – to get the downside protection. As an alternative, many clients choose institutionally priced COLI products that offer separate accounts, some with fixed return accounts, as well as indexed funds that have no ‘caps,’ as part of the product. And since COLI is normally used to informally fund deferred compensation plans, the premium flexibility afforded allows for varying employer and employee contributions. This product is far from perfect for everyone. In most cases, the client must be a ‘qualified’ buyer before a carrier will allow the purchase.”

How to improve UL products

These two producers know their markets and products inside out. Being fully aware of that, I asked them if, given the opportunity, they could advise an insurance carrier on how to improve on the UL model, what would they recommend and why? Schiff told me, “I would recommend that carriers be limited in the number of times that they can change their fees, or limit their ‘caps,’ in IUL and provide better disclosure to the public about this product.”

For Kelly, demographics come into play. “I am a baby boomer, and I want options!” he told me. “Create products that the actuaries would themselves buy.”

Next week: Part II of this interview with R. J. Kelly, CLU, ChFC, IAR, MSFS, and Matthew E. Schiff, CLU, where topics will include:

• What type of UL for what type of client?

• When to go with UL over WL or term

• UL presentation strategies

More about the experts featured in this article:

R.J. Kelly, CLU, ChFC, MSFS, strives to accomplish an ideal outcome for today, tomorrow, and the future, both personally and professionally. He is the founder and chief visionary officer of the Wealth Legacy Family of Companies in San Diego, which specializes in tending to the many diverse needs of closely held businesses and professional families. Mr. Kelly develops comprehensive plans that stimulate growth, provide protection, manage legacy issues, and facilitate business succession and exit strategies. He is also the co-founder and chair of The Center for Wealth and Legacy, a non-profit whose main goal is to challenge business leaders to positively impact their community. He is very active in the non-profit community and offers workshops to bring non-profit leaders together to maximize their potential and recognize opportunities for success. Other passions include his devotion to his wife and family, reading, diving, adventure travel, and making a positive difference in his world.

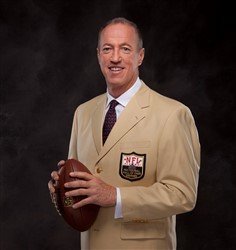

Matthew E. Schiff, CLU, is the president of Schiff Benefits Group, LLC, specializing in the design, implementation, financing, and ongoing administrative support of supplemental executive benefits programs. With more than 23 years of experience in the financial services industry, he is recognized as a leader in the deferred compensation field. Mr. Schiff is a Life Member of the Million Dollar Round Table (MDRT), with 10 Top of the Table distinctions.

Charles K. Hirsch, CLU, is contributing editor of Insurance Forums. He is also the president of Hirsch Communications Consulting, LLC, a communications consulting operation in Florissant, Mo. For many years, Chuck was the editor and publisher of Life Insurance Selling magazine and wrote the monthly column, What’s Going On in the Life Insurance Business. From 1999 to 2008, he was the publisher of several of the leading industry magazines in the life insurance, property/casualty insurance, and mortgage markets. These days, Chuck’s firm specializes in the development and execution of many kinds of communication strategies, particularly in the financial services business.