After 13 quarters of consecutive growth, whole life (WL) insurance new annualized premium fell 4% in the third quarter of 2017, according to the LIMRA U.S. Retail Individual Life Insurance Sales Survey released Dec. 4.

This decline, coupled with another double-digit decline in lifetime guarantee universal life sales, drove total new annualized premium down 2% in the third quarter.

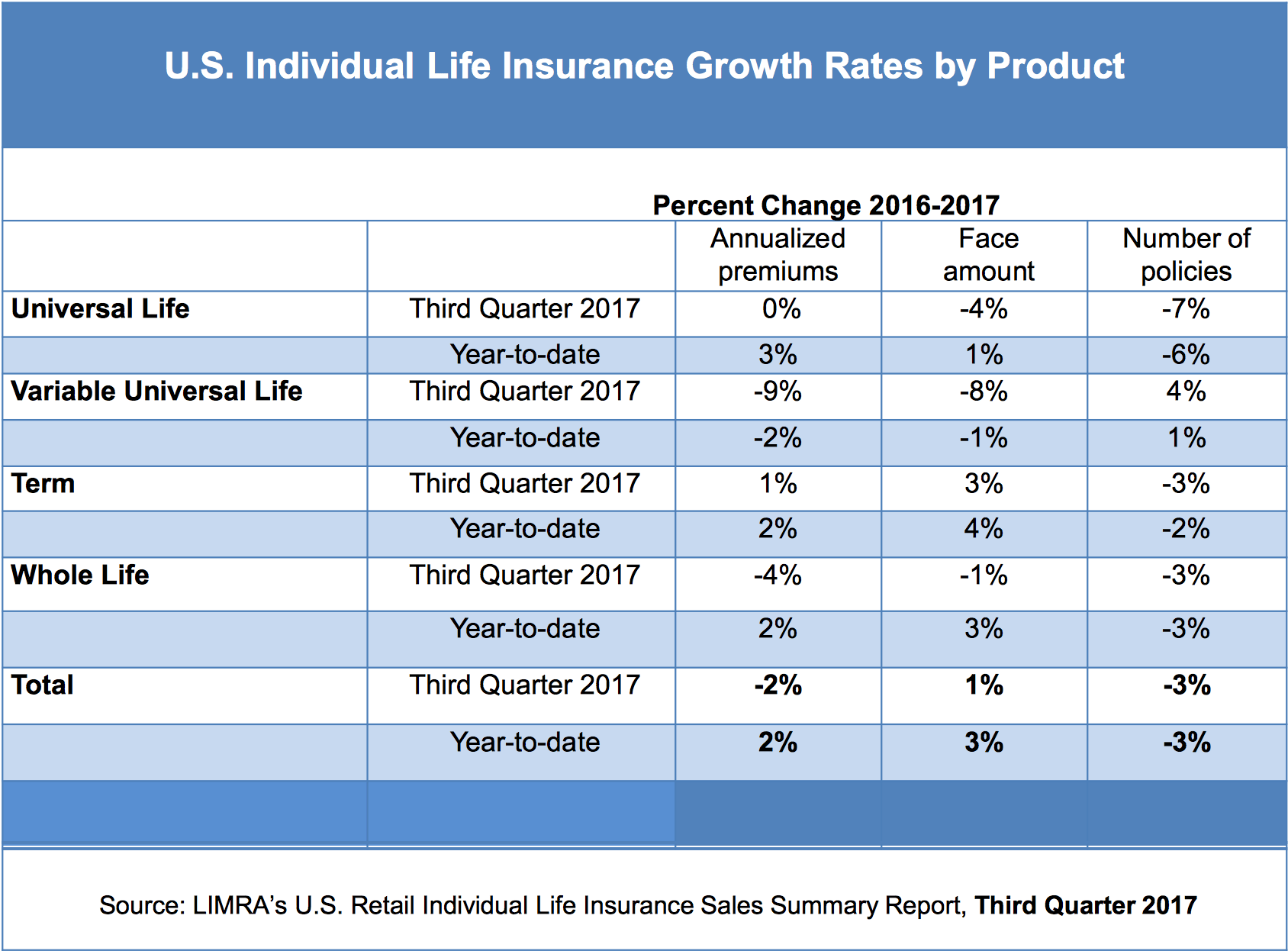

In the first three quarters of 2017, total life insurance new annualized premium remained positive, up 2% compared to prior year. Total policy count fell 3% for the quarter and year-to-date.

“Over the past several years, whole life has been a major driver of overall growth in the U.S. market,” said Ashley Durham, associate research director, LIMRA Insurance research. “However, in addition to a significant carrier exiting the market, 64% of whole life manufacturers – including 6 of the top 10 – reported declines in the third quarter.”

For the first nine months of 2017, whole life new annualized premium increased 2%, compared to prior year. Whole life represented 36% of the total life insurance premium year to date.

Universal life new annualized premium was flat in the third quarter, resulting in a 3% increase year-to-date.

Indexed universal life (IUL) new annualized premium rose 8%, with half of the manufacturers reporting positive growth. In the first three quarters of 2017, IUL increased 7%. Year-to-date, IUL premium represents 58% of the total UL premium and 22% of all individual life premium.

LTGUL new annualized premium fell 16% in the third quarter and fell 5% year-to-date. LTGUL premium represents 20% of UL sales and 7% of total life premium in the first three quarters of 2017.

In the first nine months, total UL premium held 37% market share.

Variable universal life (VUL) reversed course from the strong showing in the second quarter. In the third quarter, VUL new annualized premium fell 9%. Over half of the VUL writers reported declines in the third quarter. As a result, VUL is down 2% year-to-date. VUL market share is 5% of total premium year-to-date.

Term new annualized premium improved 1% for the quarter, and 2% year-to-date. Just under half of all term manufacturers reported growth in the third quarter.

Term’s market share currently stands at 22%. It has been in the 21-22% range since 2011.

LIMRA’s Third Quarter 2017 U.S. Individual Life Insurance Sales Survey represents approximately 80% of the U.S. individual life insurance annualized premium market.

View the latest data table on U.S. life insurance sales trends. For more statistics, visit the newly updated Data Bank.

interesting.

Stock market is doing well. This happens when it does. People start chasing returns figuring they will do great. Comes and goes with a lot of people.

I also think it may be due to raising health costs. Do you put your money into that? Or do you put it into life insurance?

Too expensive to live… Too expensive to die… and this is what creates a confused market. Now add the governments attempts at "fixing" things and presto! What?????????

Is it possible that the age shift in my generation from 55 to 65 to 75 and going on to 85 is reducing the demand for life insurance?

I think its totally related to stock market. We are on a huge bull run.

Regardless… a properly designed and funded permanent policy ain't no slouch when it comes to long term returns. Its just that 5% looks crappy when the market is kicking butt.