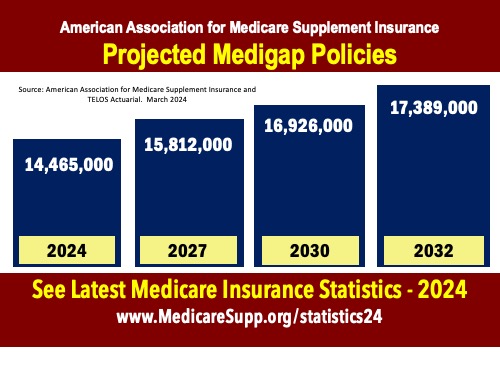

The number of individuals with Medigap insurance policies is projected to grow to over 17 million by 2032 according to data shared by the American Association for Medicare Supplement Insurance.

“Medigap or Medicare Supplement insurance remains highly attractive to millions of Medicare-eligible seniors,” reports Jesse Slome, director of the American Association for Medicare Supplement Insurance (AAMSI). The organization worked with Telos Actuarial in projecting future market growth for Medigap.

The Medicare Policyholders Forecast report, issued March 15, indicates growth from the 14.5 million Medigap enrollees in 2024 to nearly 17.4 million in 2032. The Medigap Market Data (2024-2032) can be accessed below.

“With all the focus on Medicare Advantage (MA) market growth and the various MA controversies, Medigap is often overlooked,” Slome admits. “Medigap continues to provide significant value to seniors as well as potential profitability for insurers. The expectation of future growth should be welcome news for agents, distributors and insurers alike.”

Medigap coverage, also known as Medicare Supplement Insurance, helps fill the gaps in Original Medicare coverage. Original Medicare, which includes Part A (hospital insurance) and Part B (medical insurance), covers many healthcare services and supplies, but it doesn’t cover everything. Medigap policies are sold by private insurance companies and are designed to help pay for costs that Original Medicare doesn’t cover, such as copayments, coinsurance, and deductibles.

“The projection for growth is partly due to the increasing number of Medicare-eligible individuals which should reach nearly 79 million by 2032,” said Andrew Ryba, Principal and Consulting Actuary, Telos Actuarial. “Medicare Supplement plans offer consistent benefits that many seniors seek.”

The American Association for Medicare Supplement Insurance advocates for the importance of consumer awareness and supports insurance and financial professionals who market Medicare insurance solutions.

Telos Actuarial is an actuarial consulting firm that helps insurance companies develop and manage life and health insurance products focused on the growing senior market.

AAMSI also recently issued a new report showing that California ranks as the state with most seniors covered by Medigap (Medicare Supplement), with 1.12 million. That tops Texas (931,400) and Florida (925,900), with Illinois (782,400) and Pennsylvania (706,700).

SEE ALSO: