A new LIMRA study reveals that the support young advisors receive from their firms at the beginning of their careers in financial services sales greatly contributes to their long-term success. In addition to keeping them around, the study found it is also a two-way street in the form of “reverse mentoring,” where the young advisor can help the seasoned advisor adapt to changing consumer preferences and technological advances.

Today’s advisors face many of the same challenges as their predecessors. Finding leads, asking for referrals and developing skills to run a business are just as difficult today as they’ve always been and no less important. The difference today is that new technology allows the young advisors to tackle these problems in completely new ways.

As companies invest in technology, they’ve begun to use modern approaches that build on the strengths of today’s advisors to address some of the ongoing challenges they face. While this is happening for some, many advisors are still on their own in key areas.

Currently, 7 in 10 young advisors use social media for their business and to potentially generate connections, yet more than one-third of their companies restrict or prohibit the use of social media. Seventy-eight percent of young advisors rated technology tools as important support, yet more than half of these advisors said they are not receiving enough support in this area.

In addition to technology, the study revealed several areas where young advisors want more support such as improving their selling skills and practice management.

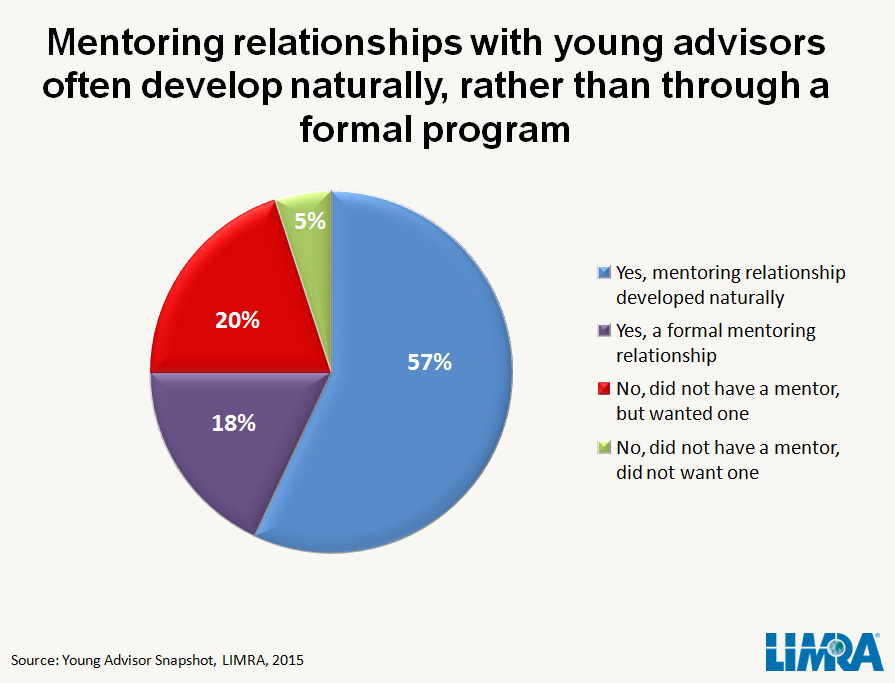

LIMRA has found that 75% of successful young advisors have benefitted from a mentor relationship. While some companies have formal mentoring programs, most mentoring relationships (57%) developed naturally.

Young advisors said the most valuable benefit they receive from their mentor is simply having someone to approach with a question. Overall, 86% said this was a benefit and more than half chose it as the top mentoring benefit. Seven in 10 said their mentor advised them about managing their practice with nearly a quarter saying this was the top benefit of having a mentor.

Participation in mentoring can often lead to “reverse mentoring” where mentor and mentee learn from each other and can form even stronger work relationships. For example, a mentor can help a Gen Y advisor with presentation skills and provide insight on how to build a successful practice. At the same time, the Gen Y professional can teach an experienced colleague about timesaving technology innovations and how to effectively incorporate social media into a practice.

The Hanover is one company that encourages mentoring relationships to benefit both mentor and mentee.

“Our new talent is eager to learn from our experienced employees, while our early-in-career professionals bring a new perspective and reverse mentoring for fresh ideas and new technological skills,” said Christine Bilotti-Peterson, senior vice president and chief human resources officer at The Hanover. “When coupled with the vast industry knowledge of our tenured employees, our multigenerational workforce is coming up with some very creative solutions. It’s a win for new talent, a win for experienced employees, and a win for our company.”

Beyond mentoring relationships, a majority of young advisors partner at least some of the time with another professional. Forty-four percent said they plan to partner more. These partnering efforts bring together financial professionals of all ages and result in more varied service offerings to their clients and prospects.

Whether they work with a mentor or form networking and study groups, Gen Y advisors have found that collaboration can lead to financial success. Prior LIMRA research found that insurance professionals who collaborate earn 49% more than those who do not.

The absence of a mentoring relationship can also have an impact. Twenty percent of young advisors did not have a mentor but wish they had one. Compared to those who had a mentor, this group was less likely to be “very satisfied” with their career and less certain they will “absolutely stay” in it.

Early career support can provide a return on investment for companies in the form of retention. Ninety-one percent of young advisors who have been in the career for at least two years are satisfied in their career, with three quarters saying they will definitely stay for the next three years.

LIMRA, a worldwide research, learning and development organization, is the trusted source of industry knowledge, helping more than 850 insurance and financial services companies in 64 countries. Visit LIMRA atwww.limra.com.