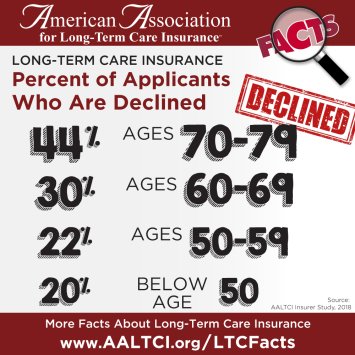

Nearly half of individuals 70 or older who apply for long-term care insurance are declined coverage due to existing health conditions according to a just-released study conducted by the American Association for Long-Term Care Insurance (AALTCI).

“Individuals mistakenly believe they can obtain long-term care insurance protection at any age,” said Jesse Slome, director of AALTCI. “It is especially harder to health-qualify at older ages because our health changes and it rarely gets better as we age.”

The Association just released results of a study of leading long-term care insurance companies. According to the findings, 44% percent of individuals age 70-79 who applied for coverage were declined, which is an identical rate to the same study in 2014.

“That means they took the time to work with an insurance agent who completed and submitted an application,” Slome said. At younger ages the percentage of individuals declined for traditional long-term care insurance policies is lower but still significant – and increasing, according to the AALTCI data.

“This year’s study found the percentage of declined applicants increased compared to the similar study conducted a few years ago,” Slome said. “The decline rate for individuals between ages 50 and 59 was 22% in 2017 compared to our 2014 buyer study when the decline rate was 17%.”

The decline rate for applicants ages 60-69 was 30% (25% in 2014) and below age 50 was 20% in 2017 compared to just 12% in 2014.

The decline rate for applicants ages 60-69 was 30% (25% in 2014) and below age 50 was 20% in 2017 compared to just 12% in 2014.

“So many Americans take medications which mislead us to think we are in good health when we really are in good controlled health,” Slome said.

He says consumers should start thinking about long-term care planning in their 50s, when costs are lower and, more important, applicants are far more likely to meet the required health qualifications.

“Once your application is accepted your coverage can not be cancelled even when your health changes, and it will change,” Slome said.

It's not harder to health-qualify for long-term care insurance. Insurance companies have relaxed underwriting requirements over the past 5 years. The problem is that many people are delaying looking into long-term care insurance until they have a health problem.

I definitely think its harder today, simply because streamlined underwriting for applicants under 60 is no longer the norm.

have you looked at the Mutual of Omaha or Genworth underwriting guidelines lately?

Only wrote a few applications in this field, but quickly realized it wasn't for me.

The hand writing is on the wall… I think this sort of insurance has a declining client base, a more medically challenged potential new client base, in a business area that has seen cost sore.

Miscalculations have cost companies too much and now they are responding to market shifts. Not to mention new medical screening technology that detects future health risks which only add to new client declines. I will also add the clients positioned for this coverage are either taking care of ailing parents, helping children financially or both… none of this is an industry plus.

Traditional LTCI is next to dead. Traditional Hybrid Policies have terrible ROIs.

Life with a LTC Rider is the future of LTCI.

That's the dumbest thing you've ever posted on this forum.

It's obvious you've done very little traditional LTCi.

Yes, you are correct… but I did enough to know that it was something I didn't want to touch… :nah: but in the long run the market will very likely prove me out.

The Traditional Long-Term Care Insurance Market Crumbles

You sound like health insurance agents did before Obamacare killed the individual health market.

You also sound the same way you did years ago when you said that rate increases were "under control" and would not be as bad in the future.

The writing is on the wall. Plenty of traditional policies are still being sold and I doubt it will go away entirely anytime in the next decade. But over the next decade, you will see the market get taken over by life insurance with long-term care Riders. The market is also moving towards insuring people at a younger age because of this. It allows people to effectively plan for long-term care in their 40s instead of in their 50s/60s. And people in their 40s love life insurance with long-term care Riders.

If life insurance with a long-term care rider was a good deal, you'd be right.

You are welcome to convince me otherwise. But the fact that you think it is not, imo, shows you are not well informed on the current options that exist. Or, you do not understand how to properly position the product. But I think you would be capable of understanding if you had taken the time to fully vet the options available.

This forum's starting to turn into the FE forum. :twitchy:

Lets hope not! lol

Scott knows a lot about LTCI, I will give him that. A lot of health agents knew a lot about health insurance… they were still wrong about it's future. Vested financial interest can create a biased opinion.

Let the fun begin… let's slug it out until someone ends up in a coma,:laugh: for the long term.

Maybe if you and I start hanging out in the LTCi forum, we can help stir up some sh*t in here too. :biggrin:

Here's a couple I'm working with right now:

both 57 years old.

both non-smokers.

both have family history of cognitive impairment.

she takes Rx for well-controlled asthma and anxiety.

he has no health issues.

h/w are ultra preferred for both.

They will retire within 5 years.

They do own a deferred annuity.

They want to receive care at home, if possible.

They are comfortable co-insuring up to $30,000 per year for the cost of their care.

Protecting assets for one another is very important to them.

they've got well over one million in invest-able assets.

their projected retirement income is well over $100,000 per year.

Why would a hybrid be better for them than a traditional LTCi policy?

Sure, but you left out how much your recommendation is going to cost them per year and how much in benefits it will provide them.

And notice that I did not say Hybrid Policy. I said a Life Policy with a LTC Rider. (I think of a MoneyGuard type of policy when an agent says "hybrid ltci")

Also notice that I said the average age of becoming insured will drop from where it is at now.

:nah:… gonna let them do their own stirring for now… I think they've got a good start, just a little push. :yes:

$1.5 million of shared benefits.

One spouse can use no more than $1.0 million.

Combined annual premium is: $4,133.

And how much do they currently have in life insurance, and what do they pay for it?

I don't know.

Why does that matter?

NGL?

NGL. We can do a 10pay for about $8K per year.

Because it is life insurance we are talking about. It goes to the positioning aspect I spoke of. You cant sell someone life insurance without knowing if they already have life insurance, and how much they pay for it. And you cant make a proper recommendation without that knowledge either.

For a situation such as that, at that age, I would most likely look at transferring a portion of their assets over to a WL or IUL with a LTC Rider. But it would likely replace a portion of their existing life insurance coverage. And how much to contribute would depend on a variety of factors.

It will kill 3 birds with 1 stone so to speak. Grow the money, provide LTC Protection, & also provide a Death Benefit. It is not a "use it or lose it" situation, and people like that. It does the same as "Hybrid LTCI Plans", just better.

Or, they could go with a GUL that offers ROP, LTC Benefits, & the option to receive the DB as retirement income if you no longer see the need for the policy. But at their age and position, it likely makes more sense to go with a product that has a liquid Cash Value they can access.

And yes, it would cover home care. And no, it would not require permanent impairment to pay benefits. Again, you have to know how to properly position it. Which requires the correct fact finding.

—

The real sweet spot for these policies are people in their 40s and early 50s. Which is why I predict that the average age of getting insured for LTC will drop over the next decade.

Let's assume they don't have any life insurance, what would you recommend for them.

What will their total LTC premiums be over the course of their life?

What is the product allocation of their assets?

Since you mentioned staying at home is extremely important to them, are your clients comfortable with the NGL requirement that they have to access home care by and through a home care agency?

(Just curious)

Question: What will their total LTC premiums be over the course of their life?

Answer: It depends upon when they start to need care. If we do a 10-pay then their total LTCi premiums will be about $89,000 unless they need to file a claim within 10 years.

What is the product allocation of their assets?

"Product allocation?" I assume you mean "asset allocation". With the recent market gains, right now about 90% of their investments are in equities–mostly large cap dividend-paying stocks in retirement accounts.

The rest is in cash holdings: money market, a few small C.D.'s, checking and savings, etc…

No, I meant product allocation… as in financial products.

Your questions show that you do not understand how to properly position the product. It is more than just a normal LTCI sale, especially for someone that old with a large amount of assets.

As I suspected, you dont understand the product. Thats ok, consumers do!

And the correct answer to my first question, is that they have no clue how much they will pay in premiums over their lifetime. You have said yourself you dont sell short pay policies. And no way those rates are staying level.

The life insurance option is exactly that, an option. Many consumers prefer it because its not a 1 trick pony. But imo, it is going to take over the LTCI industry. Life agents are already insuring people in their 40s (for LTCI) on a regular basis. That will hurt traditional LTCI sales over the next decade big time.

So what would you recommend for this couple?

Are you going to just speak in generalities or will you get into specifics?

You won't speak in specifics because you know it doesn't make sense for this couple to own a hybrid.

57-years old is NOT old. The average long-term care insurance policy is purchased at age 59. You said that hybrids are better. If a hybrid is not better for a typical buyer of long-term care insurance, then just admit and stop your charade.

Or, provide some details:

How much premium will your solution be?

How much death benefit will they get?

How much in long-term care benefit will they get?

Will the policy have a chronic illness rider or a 7702(b) rider?

P.S. Hybrids ARE a one-trick pony. In the end they will only do one thing for the policyholder. Hybrids are like Swiss army knives. They do a lot of things but they don't do any of them very well.

Hybrid Policies Have Pitfalls No One is Talking About

Im not ignoring anything. This type of sale is an asset transfer sale. It is using existing assets to leverage a LTC Benefit. The recommendation is dependent on the makeup of their current assets.

You are again ignoring what I said and trying to twist my words. I realize you have an agenda, but this is beneath you.

I said that Life Insurance with a LTC Rider is the wave of the future.

I also said that the average age of insureds is going to drop dramatically over the next decade because of this.

I have already given details, you ignored them.

They could likely do a single premium of around $100k each to get around $750k in LTC benefits.

Cash Value would grow around 2%-3%.

Death Benefit would be slightly over the LTC benefit.

7702(b)

Again, for a second time, I am not talking about "Hybrid LTC Policies". I am talking about true life insurance such as a Mass 10pay, or Guardian 10pay, or Midland, or Protective, or AG or Pru or Nationwide.

I agree that "Hybride LTC" (MoneyGuard type of products) are not great at doing anything. That is why I have never sold one. But they are very different than a true Life Policy with a LTC Rider.

Most of their net worth is in their retirement accounts. It's at or slightly above $1M.

They've got about $150K in cash, savings, checking, a couple small C.D.'s.

And they've got about $85,000 in a deferred annuity. It's an older annuity they put money in. It's paying 3% (that was the floor when they bought it.)

Work your magic.

This is obviously better for you than selling a traditional long-term care policy, but why is this better for them?

Ive already stated the benefits. If you cant figure it out that is on you. Consumers understand the benefits perfectly.

From a business perspective, you are missing out on a very big opportunity in the market.

You've already stated the benefits?

Is that really the best you can do?

Here's just a few of the reasons why your plan is a lot worse than traditional long-term care insurance:

NEVER* Combine Long-Term Care Insurance with Life Insurance – LTCShop.com

That "article" is a nice sales pitch. But has few actual facts. It is disingenuous at best… more like misleading and selectively omitting info. And I actually agree with you that Hybrid LTC Policies are not a great deal.

But, that article is talking about a different product than what I am talking about. You still dont get that….

The product(s) you're talking about are single-premium whole life with 7702(b) TQ LTCi riders, right?

Here is an actual unbiased article that compares Traditional LTCI to Hybrid LTCI:

New Hybrid Long Term Care Insurance Policies Are Risk Free – LTC Partner

Nope

Bashful?

It doesn't matter if it's an SPWL, SPUL, SPGUL, SPIUL, SPXYZ…

It's the SP that's the problem.

The opportunity cost is HUGE!

With my plan they can keep their $200,000.

And they're not having to pay a $100,000 deductible per spouse.

As I understand the life policy they don't offer any inflation protection, is that accurate?

That's a very specific question, Bluemarlin. I'm not so sure scagent will want to be that specific. He can't tell us too much about this policy, because we just wouldn't really understand it. Only he can understand this policy and the few consumers with whom he's willing to share this special knowledge.

It depends. A GUL would not. A WL would.

As far as true Hybrid LTCI goes, it used to be an option on most, I think it still is.

It is not just 1 specific policy, there are many options out there, WL/GUL/IUL. I have already given a partial list of carriers.

None of that is accurate.

Thanks for the reply. Just for kicks what about rates for a 62 year old female looking for 6000 monthly benefit with inflation for Tennessee.

It is accurate, but it doesn't fit your narrative.

The truth is that your plan is GREAT if they never need long-term care.

If they do need long-term care, they essentially have a policy with a $100,000 deductible PER SPOUSE.

With my plan they can keep their $200,000 invested. They can allocate only 2% of the return each year to pay their LTCi premium and they can reinvest the rest of the return. If they need care, they don't have to pay a $100,000 deductible per spouse.

Plus, if they want to use their $100,000 in cash, they don't have to pay any surrender charges.

Plus, if they want to use their $100,000 in cash, they don't lose their long-term care benefits (or pay an ins. co. interest for borrowing their own money.)

Permanent life insurance policies, especially the single premium policies, are rarely the best way to plan for long-term care.

Look, you're selling Swiss army knives. They are really cool. But, if you need to cut something, you're going to find a real knife. If you are going to wrap a birthday gift, you're not going to pull out that little Swiss army scissor are you? You're going to get a real pair of scissors.

Which is more important when buying insurance:

What it pays if you need it?

Or what it pays if you don’t?

"Use it or lose it" isn't a flaw in traditional LTC insurance, it's a FEATURE!

… because you are not paying extra for benefits you don’t need!

P.S. Yes, you'll make about three times the commission selling $200,000 of single premium hybrid then I will make selling the same couple a $4,000 annual LTCi premium. Good for you.

Oy Vey

Well actually Tyler, linked benefit LTC policies like MG are great at providing inflation adjusted LTC benefits with Return of Premium for a fixed cost. There is a big market for this specific type of policy. I will invite you to sell one sometime in the future.

View attachment 4388 View attachment 4388

What good is a fixed price when it's priced 2x to 4x higher than a price that may go up.