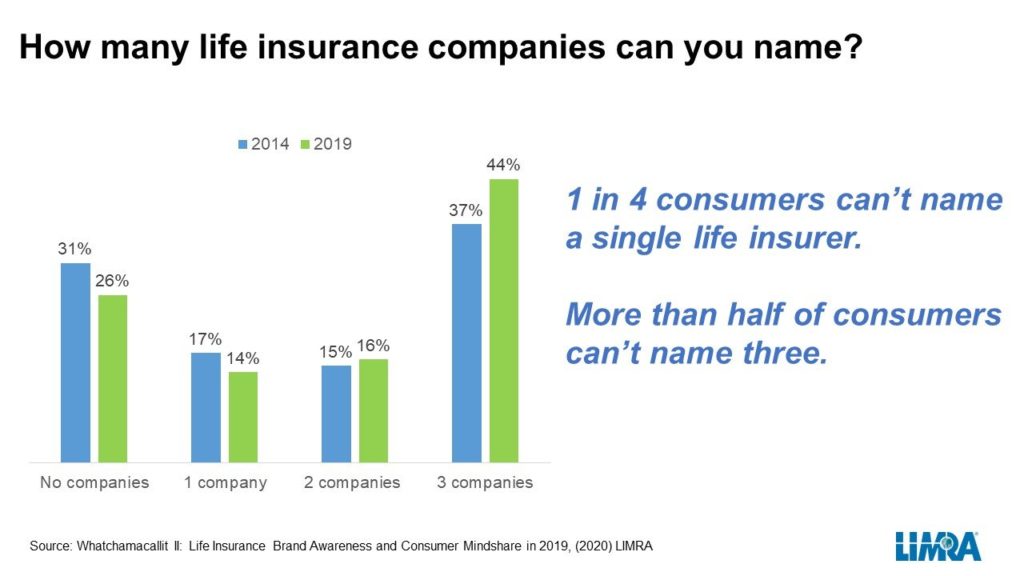

A new LIMRA study finds 1 in 4 adult Americans cannot name a single company that sells life insurance and a majority (56%) are unable to name three life insurance companies.

As discouraging as this may sound, it does reflect an uptick in unaided awareness of life insurance brands among U.S. consumers, compared to 2014 results.

Over the past 5 years, life insurers have been increasing their advertising and marketing budgets to increase consumer awareness and garner greater mindshare.

Over the past 5 years, life insurers have been increasing their advertising and marketing budgets to increase consumer awareness and garner greater mindshare.

According to a 2017 Aite Group report, the life insurance industry was projected to spend $5.6 billion in advertising and marketing in 2020, up 49% from $3.7 billion in 2016. According to the study, insurers were investing more dollars in social media, internet marketing, and radio and television.

One of the biggest challenges for life insurers is that consumers generally buy life insurance only once or twice during their lifetime, and according to LIMRA sales data, more than a quarter of policies sold are by independent agents and advisors, unaffiliated with a specific company. In these cases, it may be consumers are more aware of who sold them a policy than the company that underwrites it.

In LIMRA’s survey, 1,500 consumers named 200 unique companies (including some insurance agencies and nonspecific companies like “Mutual”) out of the close to 800 life insurers in the U.S. However, there were 10 companies mentioned the most, representing 61% of the consumer mentions (see graphic).

What prompts brand awareness?

The top two factors driving consumers’ awareness of life insurers are advertising (46%) and whether the consumer owns a product from that company (34%). A company’s reputation is also a key driver of brand awareness. For those who cited reputation, 81% said the company they mentioned had an above average or excellent reputation.

Over the past five years, as life insurers have increased their digital advertising, more consumers report seeing advertisements for life insurance. In 2019, 57% of consumers said they recalled seeing an ad for life insurance in the prior three months, up from 35% in 2014. But advertising doesn’t always ensure brand awareness. In 2019, nearly half of those who remember seeing an ad don’t recall the name of the company sponsoring the ad.

The study suggests increased advertising has helped to improve brand awareness among consumers. However, researchers believe some companies may find more success with their advertising by targeting individuals or market segments that have been identified as more receptive to the messages, based on available data, Big Data and analytics.

I think this is GOOD news! Why? Because I believe that more agents are doing more personal branding than fueling more corporate brand images.

As John Savage said, “People don’t buy insurance. People buy people.”

I think this is GOOD news! Why? Because I believe that more agents are doing more personal branding than fueling more corporate brand images.

As John Savage said, "People don't buy insurance. People buy people."

Amazing, 75% of adults can name a life insurer? I wouldn't expect that more than 5% know the name of a congressman in their district, <20% know the name of their town's mayor, <40% President US…the list goes on, but seriously 75% know the name of a life insurer, but less than that amount know if they're male or female. Great.

This is fantastic: If You have been in this arena for any amount of time there is one fact to understand.. You will never hear from a Client that their Life Insurance package was too Big..

Yes it’s true You don’t have to Die to reap the benefits of a Life Insurance policy.. Ask about living benefits..

2nd a Life Insurance policy should be presented with Income protection..

Thank You Insurance Forum for keeping us aware..

Kind Regards : Glenn Melcher

Not surprising…..

Clients I've encountered that already have policies don't even know the name of the company …… but they pay them each month though

Also of the companies, the average person is only familiar with Mutual of Omaha – apparently they have really made themselves into household name

Scary

yup, if I had a dime for every consumer I have seen with the big Life companies of GEICO, Progressive & Liberty Mutual………………….I still wouldn't have a single penny

Most consumers surveyed were obviously naming off the PC carriers that spend the most TV advertising. Pretty sure GEICO & Progressive don't manufacture any life insurance & I believe Liberty or Allstate clients purchase term from like Lincoln Benefit.

View attachment 5976

""One of the biggest challenges for life insurers is that consumers generally buy life insurance only once or twice during their lifetime, and according to LIMRA sales data, more than a quarter of policies sold are by independent agents and advisors, unaffiliated with a specific company. In these cases, it may be consumers are more aware of who sold them a policy than the company that underwrites it.""

>>consumers generally buy life insurance only once or twice during their lifetime

Really? Many of the people I sell have or have had insurance.

>>consumers are more aware of who sold them a policy than the company that underwrites it.

I find that to be true. Unless it is one of the captive shops like New York Life or their P&C company.

Yes, back in the day when i was a life insurance agent the insured often told me to make sure the beneficiary does not know they are the beneficiary. I told them, if that is the case they should just give me the premium because you are wasting your time and they will never receive the benefits. They have to be told who the company is so they can store it and reach out to them when the time comes. Most individuals don’t know they are the beneficiary or totally forgot the name. Some insurance companies will try to reach out to them however, if they do not know the insured passed away and think the premium has just stopped they will not search for you.

We created FindYourPolicy.com years ago to assist insured and beneficiaries from misplacing the name. If you have the name your are Golden. That’s all you need.

Michael

I agree that the beneficiary should have some information. I collect as much contact information on them as I can.

I do not agree they are throwing their money away. They just need to have a file with all of the information available when they die. A wise agent has their information plastered all over the folder and policy.

Companies do search the death rolls of dead clients.

Hello WinoBlues.

Yes i agree they would not be throwing their money away. I was just trying to get them to think about what they were asking me to do. And it is very important for you as an agent to collect as much information on them as possible. However, if you have the information and no longer can contact your client because they moved and did not update the address on their policy it really does cause other issues. When an individual buys a policy over the internet they really must think of the beneficiary.

It is very important the insured informs their beneficiary and even more important the beneficiary keep a record of the company name of the policy.

Yes the insurance companies are asked to search the Death Masters File for their dead clients, however due to the fraud that was going on when the database was accessed the Death Masters File is limiting what you can see. So it is not 100% accurate. (this can be googled) However anything one can do to assist consumers to locate the policy, I am all for.

FindYourPolicy is a company where an individual with life insurance or the agent who sold it to them can register for free the company name they have life insurance with. There is no way anyone can steal your insurance policy as they must go through scrutiny of the Insurance companies as they do not want to pay out the wrong beneficiary.

We are in the process of changing our website to free searches as well so it is even more consumer friendly.

Note: we will never sell or rent out any information

Michael.

Michael I agree with some of what you are saying. I also understand you have a business that offers this. A suggestion – start a thread speaking about beneficiary and claims. Do not sell your service to hard or these guys will eat your liver. Informed information is a great way to draw agents to you. Spam is a great way to repel them.

I fully agree that beneficiaries should be able to find claim information at time of need.

Back in the day of real insurance agents you just called the family insurance guy. You usually had his number in your phone book.

Hello WinoBlues,

The more i go over what i said the more i agree it sound like a promotion. I apologize for that. I just truly believe there are options for individuals to take so that their beneficiaries won’t lose the company name the insured has life insurance with.

Yes back in the day it was easier but with being able to buy life insurance over the internet it really changes a few things. Thank you for discussing this with me.

Michael