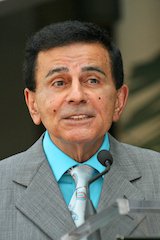

Who will receive the death benefit from Casey Kasem’s $2,082,231 life insurance policy remains very much up in the air following MetLife’s decision last week to sue both his widow Jean Kasem and his four children (including three from his first marriage).

The suit, filed Oct. 30 in federal court, effectively asks a judge to decide to should get the proceeds from the policy in the wake of the beloved former “American Top 40” host’s death at the age of 82 on June 15. The adult children believe that Jean Kasem, trustee of the Casey Kasem Trust, may have been “involved in his death,” which if proven would disinherit her under California Probate Code 250.

In a Nov. 3 article on Courthouse New Service, MetLife says that without court intervention, it is “faced with the real and reasonable potential of duplicative or multiple liability.” Calling itself an “interested stakeholder,” MetLife says it cannot pay out the death benefit “given the competing interests,” and requests that a judge settle the dispute and absolve the insurer of liability.

While the adult children assert that Jean Kasem essentially killed Casey by neglecting his care (she removed him from a nursing home, and he subsequently suffered a stage three bed sore and dehydration under her care), Jean’s lawyer sent a July 31 letter asserting that “one or more” of the children may have had a role in the insured’s demise.

As Casey Kasem’s health continued to deteriorate in 2013, Jean prevented any contact with her husband, particularly by his three children from his first marriage. In early 2014, it was announced by daughter (from his first marriage) Kerri Kasem that Casey was suffering from Lewy Body dementia, and due to his condition, he was no longer able to speak during his final months.

• Want to chime in with your thoughts on this strange case? Please visit this thread now.

On Oct. 1, 2013, the three children from his first marriage staged a public protest in front of the Kasem home, having not been allowed contact with their father for three months. Jean removed him from his Santa Monica, Calif., nursing home in May 2014, taking him secretly to Washington state. Later that month Kerri Kasem was granted temporary conservatorship over her father, despite Jean’s objection.

This was due to Casey’s signing of a Critical Health Care Directive document back in 2007, when he was first diagnosed. It was intended to allow a trusted loved one to end life support when it appears that the suffering is too severe and the hope of recovery too slim, which was the case not long after Kasem was admitted to a hospital after turning up in Washington state.The Critical Health Care Directive stated Kasem did not want to be kept alive if it would result in a mere biological existence, devoid of cognitive function, with no reasonable hope for normal functioning. The document nominated Kerri to make the decision of when was the appropriate time to honor this wish and cut off life support.

Presumably, the July 31 letter from Jean’s lawyer asserting that “one or more” of the children may have had a role in the insured’s demise arose from Kerri’s decision as conservator to cut off life support. The adult children argue that Casem should have remained in the nursing home, receiving proper care that could have prolonged an acceptable quality of life. To make things worse, there are reports suggesting Kasem’s body remains unburied as the adult children are also fighting to prevent Jean from having him interred in Norway instead of his native U.S.

MetLife, which had filed a similar suit to the Oct. 30 suit on Oct. 3 relating to Casey Kasem’s Children’s Irrevocable Trust, has volunteered to place the $2,082,231 in court registry until the cases are settled.

The entire situation is merely the latest example provided by a deceased celebrity underscoring the importance of having a proper estate plan in place that will minimize the chances of family disputes, particularly for elderly clients at risk of dementia.

• Want to chime in with your thoughts on this strange case? Please visit this thread now.

Estate planning mistakes as illustrated by celebrities:

• Doing nothing (see Jimi Hendrix; Sonny Bono; Steve McNair)

• Not updating (see Heath Ledger; Michael Crichton)

• Incomplete planning (see Marilyn Monroe, Jim Morrison, Michael Jackson)

• Choosing an untrustworthy executor (see Doris Duke)

• Failing to build in tax efficiencies (see James Gandolfini, Philip Seymour Hoffman)