New York Life will become the first U.S. life insurer to use electronic health records to accelerate and improve its underwriting process and capabilities, through a new agreement announced in late October with Epic, a leading comprehensive health records system.

This advancement, New York Life says, will dramatically shorten the life insurance application process and improve the customer experience.

“The length of time it takes to complete the life insurance application process can deter people from getting the life insurance they need to protect their loved ones,” said Alex Cook, senior vice president and head of Retail Life. “Transitioning to a digital model for health record processing will significantly reduce application processing time, easing the process for new clients and delivering a better experience for our customers.”

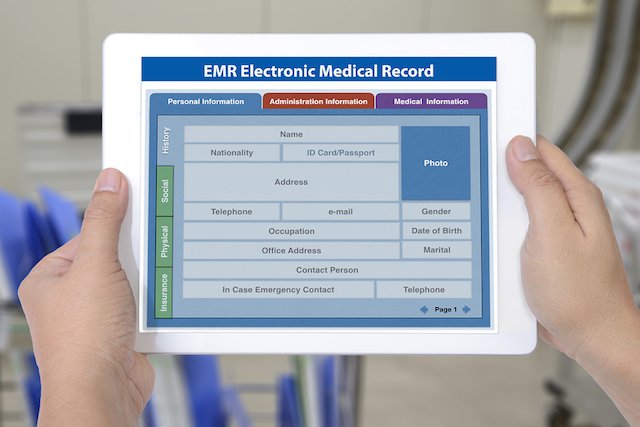

Life insurers use medical records to help inform underwriting decisions. Until now, medical records were shared with life insurers as scanned or faxed copies, a labor-intensive process for gathering and reviewing the necessary documents. New York Life will use Epic’s Chart Gateway to connect with healthcare organizations to retrieve electronic health records for life insurance applicants, with their consent. The new process will allow New York Life to securely and efficiently get the information required to process applications faster, while lessening the administrative burden on healthcare providers.

Cook added, “This is another step forward in New York Life’s strategy to make life insurance more accessible and easier to understand and purchase. Every investment we make to improve the process for purchasing life insurance will help streamline consumers’ ability to obtain the coverage they need.”

Cook added, “This is another step forward in New York Life’s strategy to make life insurance more accessible and easier to understand and purchase. Every investment we make to improve the process for purchasing life insurance will help streamline consumers’ ability to obtain the coverage they need.”

About New York Life: New York Life Insurance Company (www.newyorklife.com), a Fortune 100 company founded in 1845, is the largest mutual life insurance company in the United States* and one of the largest life insurers in the world. Headquartered in New York City, New York Life’s family of companies offers life insurance, retirement income, investments and long-term care insurance. New York Life has the highest financial strength ratings currently awarded to any U.S. life insurer from all four of the major credit rating agencies**.

*Based on revenue as reported by “Fortune 500 ranked within Industries, Insurance: Life, Health (Mutual),” Fortune magazine, 6/1/18. For methodology, please see http://fortune.com/fortune500/

**Individual independent rating agency commentary as of 7/30/2018: A.M. Best (A++), Fitch (AAA), Moody’s Investors Service (Aaa), Standard & Poor’s (AA+)