What are your most pressing technology issues as an insurance agent? Recently, a forum member came to the forum to seek input on his potential software development company. He has been seeking an understanding of the trials and tribulations that agents face, in order to try and assist them with these problems through technology.

Agents reported that referrals, retention percentages, and lead generation were three of the most vital issues that they focus on. Coming up with a more streamlined system that could cut down on time spent on these three factors would be a help to the agent community.

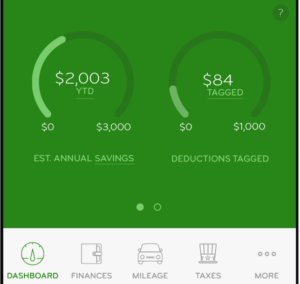

Another member noted that a software that agents could share with their current and prospective clients would also be a great idea. Providing customers with a convenient electronic way to store and administer insurance policy information in a clear-cut, simple way would help both agents and clients save a lot of time. If customers are more aware of their current insurance, they can be more knowledgeable about their current and future insurance needs.

One agent said, “How can any competent agent offer insurance to a potential buyer without knowing anything about that person’s existing policies? Auto insurance is related to home insurance, health insurance is related to auto insurance, and is more life insurance more important than disability insurance?” By coming up with a system that addresses these questions, many insurance-related pain points would likely disappear.

What software might make your job easier? Tell Brian here – and maybe he will make it a reality!

An web based quote application that lets you answer questions in front of client on your tablet or phone that gives you up to the minute information on underwriting guidelines and as you ask a medical question it narrows down what carriers will fit the clients needs and what carriers they qualify for and what the rates are based on that specific client. Dan Miller has a web based app that supplies this but I cant find it anywhere !!

A web based client info which client & producers can log into and have immediate access upon which client can look at what products their producer is recommending and why?

A web based quote system would be excellent but putting it down with only an indication given the variables attached would be proof positive in getting very close to having what is quoted to be what the insured gets.

Having a producer software that quotes every type of insurance. Term mortgage protection insurance final expense insurance annuities whole life give you quotes on all that different type of life/health insurance and let you plug into the system what and why it would be the best option. And you can add all the carriers your Licensed with. And even the carriers your not Licensed with. So you can tell the client why your recommending that product and be able to print off an illustration for some products like whole life and annuities and even a term life with a top rider. Speaking of riders add what riders can be added also. And make it very user friendly add the client and the financial situation there in and hit a button like calculate for the best insurance available to them and explaine why.

I think the web idea is ok but not all of my clients have wifi in there home. I have to use a mobile hotspot on cell phone to Wright e-apps. So I think it’s a good idea but what if there is no internet available. So I think it should be software you cam download and install on your computer. Bestplanpro is great but it only works for final expense insurance which sorta sucks. But that being said it’s great software now if you could expand that software to all products available that would be great. And not as complicated as winflex that’s a hard program to master. But it is good when you’re proficient with it I’m sure.