Lloyds of Lubbock

Guru

- 777

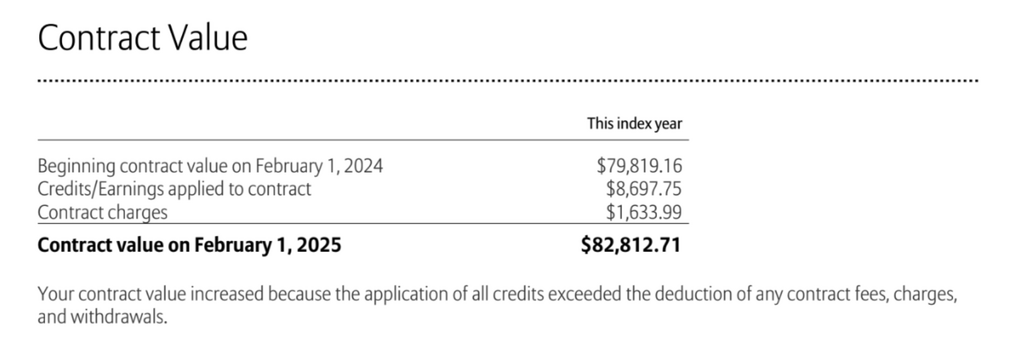

I won't mention the company but I got my annual statement.

Every year the expense range between 1500-1600.

The returns have been ok.

It is set up to hopefully provide a bit better interest than a cd, with minimal risk.

I get my annual statement, which I have included.

Every other year the numbers added up.

I called the company to get a detailed report of where my money went.

They sent me the calculations of the interest rates credited....which I really dont need.

The explanation of the expenses wass.....it's complicated.

My agent has been trying to get to the bottom of this but no one at the carrier seems to want to provide an answer.

Is a complaint to Florida Insurance department in order?

Every year the expense range between 1500-1600.

The returns have been ok.

It is set up to hopefully provide a bit better interest than a cd, with minimal risk.

I get my annual statement, which I have included.

Every other year the numbers added up.

I called the company to get a detailed report of where my money went.

They sent me the calculations of the interest rates credited....which I really dont need.

The explanation of the expenses wass.....it's complicated.

My agent has been trying to get to the bottom of this but no one at the carrier seems to want to provide an answer.

Is a complaint to Florida Insurance department in order?