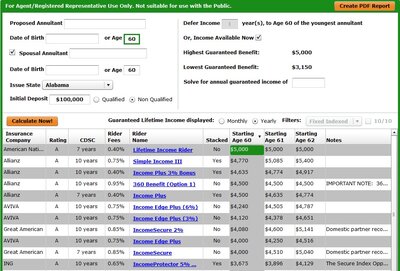

Does anyone know of any FIA products out there that have an income rider designed for "Income Now" like Pacific Life has on their VAs?

In other words, looking for a product that has a reduced rider charge and only guarantees income for life, no income base crediting while in deferral (as the client would be taking income immediately).

Would prefer products that offer joint life for the rider.

Thanks in advance.

In other words, looking for a product that has a reduced rider charge and only guarantees income for life, no income base crediting while in deferral (as the client would be taking income immediately).

Would prefer products that offer joint life for the rider.

Thanks in advance.