You can still stretch NQ annuities.didnt want the large tax bill in lump sum,

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Age 100 maturity NQ annuity

- Thread starter Allen Trent

- Start date

- Thread starter

- #12

- 5,266

some carriers, not all, right?You can still stretch NQ annuities.

I did NQ stretch of my moms NQ Variable Annuity with Lincoln, merely taking RMDs via stretch.

But the company I have worked most of my career for wont do it as they state the tax code doesnt explicitly permit it & legal counsel doesnt want the hassle.

I always wonder if it is a best interest lawsuit waiting to happen if out of ignorance you dont know if a carrier will or wont allow stretch. but I am told that beneficiaries dont have best interest legal standing like the purchaser of the annuity does.

if my memory serves me right, Jackson National started the NQ stretch via a Private Letter Ruling. So, I think smaller carriers are hesitant to rely on PLR to 1 carrier. Have never been told if it is now written in a Revenue ruling or codified in IRS code somewhere.

No, not all.some carriers, not all, right?

I did NQ stretch of my moms NQ Variable Annuity with Lincoln, merely taking RMDs via stretch.

But the company I have worked most of my career for wont do it as they state the tax code doesnt explicitly permit it & legal counsel doesnt want the hassle.

I always wonder if it is a best interest lawsuit waiting to happen if out of ignorance you dont know if a carrier will or wont allow stretch. but I am told that beneficiaries dont have best interest legal standing like the purchaser of the annuity does.

But, you can 1035 it to one that does (although not all companies will facilitate that either).

- Thread starter

- #14

- 5,266

had to do that on some IRA death claims in the 2-3 years that the IRS was making up their mind on Secure Act & Trust beneficiaries being able to use look through provision to allow trust beneficiaries to utilize 10 year deferral instead of lump sum. Some custodians of death claim were conservative & said Secure Act was silent on look through of trust, so had to do a rollover which was far from easy because of the circumstances & tax reporting. Releasing custodians still reported as lump sum taxable, not as a rollover/transfer. CPA & consumers crossed their fingers & hoped it could be addressed on tax return as an indirect rollover to get it to more aggressive custodian that would allow look through into trustNo, not all.

But, you can 1035 it to one that does (although not all companies will facilitate that either).

You can do anything you want on your tax return until you get audited.had to do that on some IRA death claims in the 2-3 years that the IRS was making up their mind on Secure Act & Trust beneficiaries being able to use look through provision to allow trust beneficiaries to utilize 10 year deferral instead of lump sum. Some custodians of death claim were conservative & said Secure Act was silent on look through of trust, so had to do a rollover which was far from easy because of the circumstances & tax reporting. Releasing custodians still reported as lump sum taxable, not as a rollover/transfer. CPA & consumers crossed their fingers & hoped it could be addressed on tax return as an indirect rollover to get it to more aggressive custodian that would allow look through into trust

Then you'll find out if it was legit or not lol.

- Thread starter

- #16

- 5,266

yup, good thing is indirect rollovers are pretty common where releasing company reports as taxable & then taxpayer & CPA have to mark that it was an indirect rollover....................then cross fingers for a few years to see if audited, then if audited cross fingers auditer agrees it was OKYou can do anything you want on your tax return until you get audited.

Then you'll find out if it was legit or not lol.

only took our government 4 years to figure out how to create rules/regulations from the Secure Act that was enacted 4 years prior

new issue is the weirdness of inherited IRAs not needing RMDs in years 1-9 of 10 year deferral if deceased was younger than RMD age, but required to take RMDs from inherited in years 1-9 if deceased was already taking RMDs. I am told some/many custodians will not be doing any calculations of RMDs for these inherited IRAs due to all the exceptions & rules related to whether you do or dont have to take RMDs during years 1-9

Sheryl J Moore

Super Genius

- 102

I read the contract specimens for a living, and cannot recall seeing an annuity with a maturity age beyond 100. :/ sjm

North American is 115.I read the contract specimens for a living, and cannot recall seeing an annuity with a maturity age beyond 100. :/ sjm

- Thread starter

- #19

- 5,266

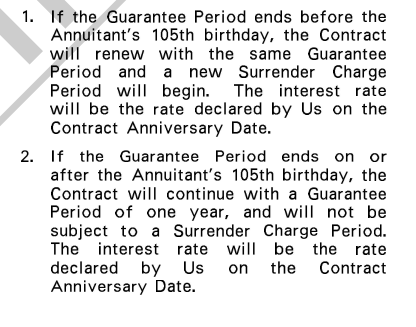

The small Michigan carrier I work for is 115 on our newer MYGA product, up from age 100 on all our previous flexible or single premium annuities.I read the contract specimens for a living, and cannot recall seeing an annuity with a maturity age beyond 100. :/ sjm

After age 105, the MYGA will only renew for 1 year rate locks to avoid locking up the carrier funds for 3,5,7 or 10 years & having a death claim where surrender charges are waived.

- Thread starter

- #20

- 5,266

also, I see alot of specimen contracts say something in the definitions like Max Maturity age will be set by us, so age 100 or 115 might not be written in the contract language. Maybe in their brochures or sales documents, etcI read the contract specimens for a living, and cannot recall seeing an annuity with a maturity age beyond 100. :/ sjm