- 7,302

No RMD's yet. I am old enough let's not rush it.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

No RMD's yet. I am old enough let's not rush it.

why would that be? never heard of qualified having more fees because it could have RMDs.Is it qualified? It could be due to RMDs if so.

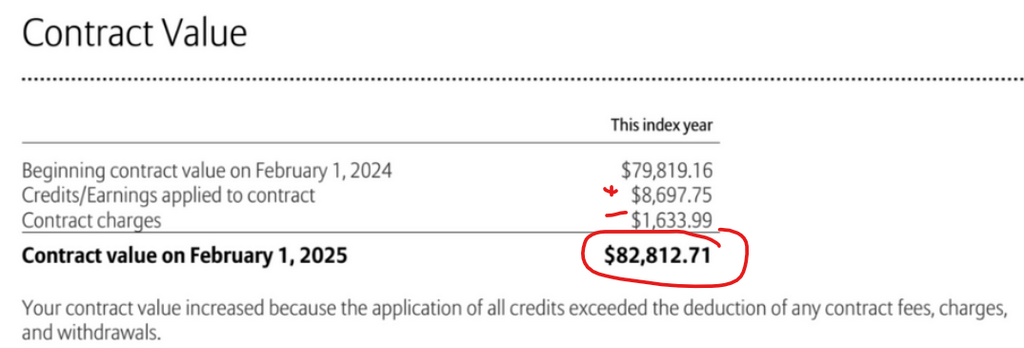

Yeah, not sure how it has $9k of interest/credits & only 1600 in fees, but only grows by $3k. horrible statement if it doesnt show distributions that happenedEither of those should have shown up on the line item view that he showed us. At least for most statements I've seen. But withdrawals are not necessarily always shown there.

I am more concerned as to how it only grew by a total of $3k, but shows it made almost 9k--that is a $6k difference, not just $1600 fee showing.No withdrawals.

No RMD's yet. I am old enough let's not rush it.

There is a lifetime income rider, which I asked to be removed two years ago.

I don't think it was.

I think it is the surrender charge.

I will wait for the agents answer.

I dont think it is a surrender charge. that should only show if you took more than free withdrawal or if they had a more robust statement showing both account value & a separate surrender value starting & ending value.I think it is the surrender charge.

I am more concerned as to how it only grew by a total of $3k, but shows it made almost 9k--that is a $6k difference, not just $1600 fee showing.

Is it possible their top number of $79.8 was your beginning account value but the ending number of $82k isnt the account value but is the surrender value?

PS_- My money is on the $1633 being fee for income rider, but it is the least concerning for me as I am wondering where the other $4k in "credits/earnings" are if they were "applied to contract as stated.

Is it possible you have a 2 tiered annuity where the credits are only applying to the annuitization value & the contract value changes by a different number. I cant understand where the missing $4k is in the math equation below.

View attachment 17784

why would that be? never heard of qualified having more fees because it could have RMDs.

My gut thinks this has some sort of income rider to a fixed product as variable wouldnt show fees like that as most are buried/hidden