- 2,394

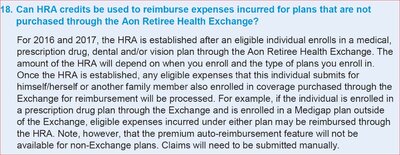

I enrolled a woman into a Humana Gold Plus for a T65 February 2017 effective back in November. When she told me that she was an ATT retiree, I asked her if she had received any paperwork from them. She said NO, so I continued with the application process. Today, she told me that AON contacted her to advise her of a $2,400/yr stipend for her healthcare provided that she goes through them (of course). I told her that she must buy ONE product to receive the stipend. She will (of course) listen to their unknowledgeable flunky and go from there. What kind of products can she buy through them to use up her $2,400/yr? Does she get to keep CASH if she doesn't use all of it?