Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Dividends

- Thread starter leo

- Start date

- 10,329

I read on a Facebook group that loans on PUA don't get dividends, is that correct?

Varies on the carrier. You are referring to Participating Loans vs. Non-Par Loans.

However, many non-par carriers just give an adjusted Dividend on Loaned funds. So it still gets something.

Read the illustration.

- 4,575

I read on a Facebook group that loans on PUA don't get dividends, is that correct?

Couple things.

1. No cash value is ever loaned out of a policy. All the cash vslue stays in the policy & the insurance company gives the owner a loan from the insurance companies assets. Insurance company takes a collateral position on the policy until loan is repaid by owner, extinguished at death or surrender.

B. Each carrier decides as to whether they pay the same or lower dividend rate on base cash value & puar value

3. Each carrier decides whether they pay the same dividend scale on policy values not hindered by a carrier collateral position or a lower dividend scale on those values collaterized by a loan from carrier.

In short, Facebook group may be correct depending on what specific carrier, what product, etc

- 2,195

Couple things.

In short, Facebook group may be correct depending on what specific carrier, what product, etc

Varies on the carrier. You are referring to Participating Loans vs. Non-Par Loans.

Both of these professionals are a much better source of information than Facebook.

Lloyds of Lubbock

Guru

- 714

Lets stick with par policies as they are more common.

Two ways a loan can be priced are:

Direct Recognition

Variable loan interest rate.

Direct recognition means that the policy recognizes there is a loan on the policy and makes an adjustment on the dividend. Currently most Direct Recognition companies are paying a higher dividend on loaned money, than non-loaned money.

If interest rates continue to rise this may reverse itself.

Direct Recognition companies also have fixed interest rates, and some give you the ability to switch from Direct Recognition to Variable.

Variable loan interest rate method has a current rate of interest that is tied to an index, which periodically is adjusted. The policy gets the same dividend regardless of whether or not there is a loan.

Which one is better? Long term they are probably just the same.

When taking a loan from a policy you may want to use a third party lender, you generally get a better interest rate. IN this case it really does not matter.

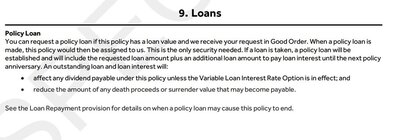

Here is a specimen policy from Guardian look at page 12 first bullet point under Dividends.

A loan affects the dividend payable. (Also on page 10)

It does not say loans are not eligible for dividends, or dividends are lower because of loans.

The attached file is taken from a specimen policy from a Direct Recognition company.

Two ways a loan can be priced are:

Direct Recognition

Variable loan interest rate.

Direct recognition means that the policy recognizes there is a loan on the policy and makes an adjustment on the dividend. Currently most Direct Recognition companies are paying a higher dividend on loaned money, than non-loaned money.

If interest rates continue to rise this may reverse itself.

Direct Recognition companies also have fixed interest rates, and some give you the ability to switch from Direct Recognition to Variable.

Variable loan interest rate method has a current rate of interest that is tied to an index, which periodically is adjusted. The policy gets the same dividend regardless of whether or not there is a loan.

Which one is better? Long term they are probably just the same.

When taking a loan from a policy you may want to use a third party lender, you generally get a better interest rate. IN this case it really does not matter.

Here is a specimen policy from Guardian look at page 12 first bullet point under Dividends.

A loan affects the dividend payable. (Also on page 10)

It does not say loans are not eligible for dividends, or dividends are lower because of loans.

The attached file is taken from a specimen policy from a Direct Recognition company.

Attachments

Lloyds of Lubbock

Guru

- 714

When you have a company previously known as Ohio Natl putting on their homepage, We are not a Direct Recognition company and loans do not affect dividends" what do you expect?

While it may be a true statement what do you think they were inferring?

While it may be a true statement what do you think they were inferring?

Similar threads

- Replies

- 11

- Views

- 2K

- Replies

- 15

- Views

- 2K

- Replies

- 3

- Views

- 970