Lloyds of Lubbock

Guru

- 755

Dave Ramsey is not a licensed professional.

He is a financial entertainer.

He is a financial entertainer.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Dave Ramsey is not an authority on annuities. sjmThanks ... Dave Ramsey says annuities are not the answer ...

Some of what funds?The other thing to be cautious of (seems to me there may have been a thread about this a while back) is that some of the funds are being moved offshore where there is less regulation

Thanks ... Dave Ramsey says annuities are not the answer ...

Thanks ... Dave Ramsey says annuities are not the answer ...

Caveat, I am not an agent.Depends on the question being asked.

Caveat, not an agent.The other thing to be cautious of (seems to me there may have been a thread about this a while back) is that some of the funds are being moved offshore where there is less regulation (not a good thing in my opinion). The involvement of venture capitalist with companies/funds worries me as they make their money by buying something, cutting costs and then reselling it for a profit (which usually means debt for the buyer thus higher overhead).

Caveat, annuity purchaser, not an agent.very, very true.

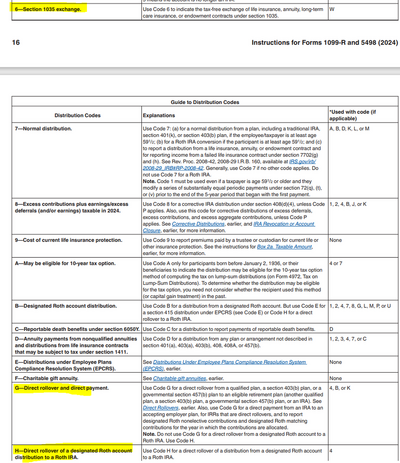

only correction I would make is that a 1035 has nothing to do with IRA or Roth funds.

A 1035 exchange only pertains to non qualified annuities going to another new or existing non-qualified annuity or a life insurance policy going to a new life insurance or new non qualified annuity. You can go to Los Angeles (Life to Annuity) but cant go to to ALabama (Annuity to Life).

I believe the correct terminology for your explanation is a Transfer/Direct Rollover/Indirect Rollover/Conversion for your points.

Before you know it, you will be well on your way to be able to start part time selling annuities

They likely just have 1 form that can be utilized for either a Direct Rollover of qualified funds, a Transfer of qualified funds or a 1035 exchange for non-qualified. But the IRS code is definitely different for each type & the 1099 R that comes at the end of the year will utilize different code #s in the distribution type for the releasing company to notify the taxpayer & IRS which type of transaction occurred.Caveat, annuity purchaser, not an agent.

North American's and Athene's application packets for FIA's include industry standard 1035 forms to move (roth in my case) qualified money held in other organizations to the carrier's accounts for an annuity purchase by a prospective contract holder.