- 1,506

Cut and paste and put on social.

If you know an Insurance agent, give them a hug, they need a Hug today.

WHEN TIMES ARE FUN and EASY, agents work hard to work up all the price points and coverage options for you. Before they call you to cover all the information to buy a policy; they are calling a bunch of different company Underwriters to discuss your teenagers and home even though they have tickets and your walk out basement it is missing a railing. It takes them time and hard work but THEY HAVE OPTIONS AND COVERAGES AND PRICE POINTS FOR YOU and they love the work.

When times are Hard (AND THEY ARE RIGHT NOW), Insurance companies want fewer Customers. (Insurance Companies are worried about profits right now specifically on personal lines as they grapple with inflation in what is being called “The hardest market in a Generation”).

As such, the insurance companies start tightening the options agents have to offer or are making the process more complicated.

So the insurance companies raise deductibles, increase hold times for the agents, change roof coverages, they stop writing folks with too many tickets, Prices skyrocket, Underwriters say no 100% of the time, the Insurance companies nonrenew the clients, and so many other things.

As such, it is really rough for Independent insurance agents because their ability to offer tons of options has been limited to only being able to offer a few options in a more complex environment.

(ONE VERY IMPORTANT NOTE: 99.9% of the time the insurance companies do all this across the board. NO AGENT HAS AN ADVANTAGE OVER ANOTHER. Example: If they are both selling a Nationwide policy, they are both dealing with the exact same product and algorithms and payment plans. Neither one can do something the other one can’t do.)

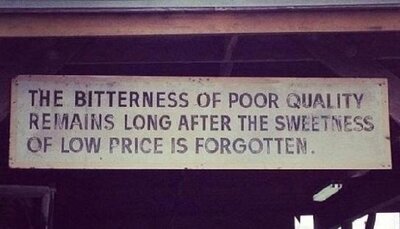

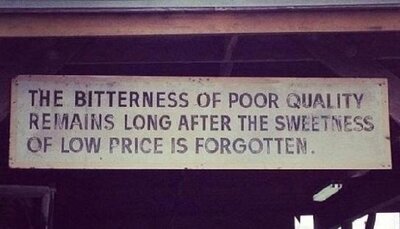

Simply put, Insurance never should have been boiled down to a 15 min process that saves you 15% or more – ESCECIALLY IN TODAYS ENVIROMENT. Insurance is complex and is changing dramatically on a regular basis. Call a professional and have them walk you through the coverage options available to you.

If you know an Insurance agent, give them a hug, they need a Hug today.

WHEN TIMES ARE FUN and EASY, agents work hard to work up all the price points and coverage options for you. Before they call you to cover all the information to buy a policy; they are calling a bunch of different company Underwriters to discuss your teenagers and home even though they have tickets and your walk out basement it is missing a railing. It takes them time and hard work but THEY HAVE OPTIONS AND COVERAGES AND PRICE POINTS FOR YOU and they love the work.

When times are Hard (AND THEY ARE RIGHT NOW), Insurance companies want fewer Customers. (Insurance Companies are worried about profits right now specifically on personal lines as they grapple with inflation in what is being called “The hardest market in a Generation”).

As such, the insurance companies start tightening the options agents have to offer or are making the process more complicated.

So the insurance companies raise deductibles, increase hold times for the agents, change roof coverages, they stop writing folks with too many tickets, Prices skyrocket, Underwriters say no 100% of the time, the Insurance companies nonrenew the clients, and so many other things.

As such, it is really rough for Independent insurance agents because their ability to offer tons of options has been limited to only being able to offer a few options in a more complex environment.

(ONE VERY IMPORTANT NOTE: 99.9% of the time the insurance companies do all this across the board. NO AGENT HAS AN ADVANTAGE OVER ANOTHER. Example: If they are both selling a Nationwide policy, they are both dealing with the exact same product and algorithms and payment plans. Neither one can do something the other one can’t do.)

Simply put, Insurance never should have been boiled down to a 15 min process that saves you 15% or more – ESCECIALLY IN TODAYS ENVIROMENT. Insurance is complex and is changing dramatically on a regular basis. Call a professional and have them walk you through the coverage options available to you.