Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Issue Age Pricing

- Thread starter VT33

- Start date

- 1,078

Your mistake was selling Plan F at all. Plan G was the much better plan if they wanted to save money and have lower rate increases.

I never saw a plan F that made any mathematical sense. Only used it in GI situations.

History lesson for ya.In Florida for the longest time UHC use to have the lowest rates and best rate stability.At the time of the encounter with this client UHC did not offer G but had she taken F she A.-could have changed to G when it become available with UHC a few years with no underwriting retaining entry age and B.- even if she would have taken F with UHC and still had it her F rate would have still been lower today compared to the G she took with Bankers' LIfe

I realize a number of agents push plans as if monthly costs were the only factors that matter. And many think that free is good. If that is the way they want to run their business, fine, but some of us do things differently.

Low premiums are fine as long as ACCESS to care is equal across all plans. But even folks who are not in the AHIP club understand the lowest premium does not always equal quality care.

Low premiums are fine as long as ACCESS to care is equal across all plans. But even folks who are not in the AHIP club understand the lowest premium does not always equal quality care.

Out of curiosity I just look up rates in my state and zip code (using medicare.gov) and if you used the max MOOP with each it looks the cheapest plan/mo is G with just the B deductible.I never saw a plan F that made any mathematical sense. Only used it in GI situations.

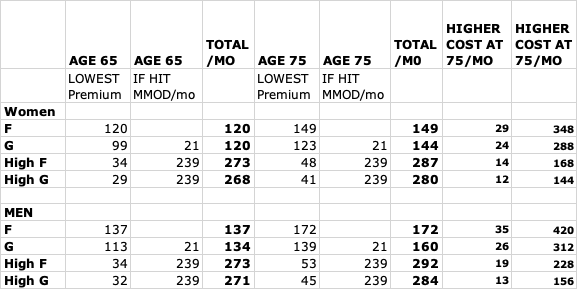

Spreadsheet is the cheapest plan in each suppliment (at the 2 ages, sex and non-smoking). Yes I am aware this isn't perfect, and why medicare.gov is even giving an F price for someone who is 65 is beyond me... however I just did this quick and dirty. And of course higher cost difference between ages 65 and 75 would be even higher if I knew what the lowest prices were 10 years ago. Best I could quickly do is compare to age 65 now.

UPDATE: Can't fix the chart without deleting the message and I can't figure out how to just delete my chart to put the corrected on in there.

The final column should be Higher Cost at 75 PER YEAR

Last edited:

And the network issues matter regardless of one's age and type of insurance. It may not matter until you are sick - however places with poor health care have other issues. And you may want a second opinion at a good place and that place may or may not be in network.I realize a number of agents push plans as if monthly costs were the only factors that matter. And many think that free is good. If that is the way they want to run their business, fine, but some of us do things differently.

Low premiums are fine as long as ACCESS to care is equal across all plans. But even folks who are not in the AHIP club understand the lowest premium does not always equal quality care.

I went out of state to MD Anderson Cancer Center (#1 cancer center in the country) and was give a treatment that locally even the university medical center didn't know about. AND they coincidentally discovered something on a scan that locally they had missed not once but twice.

I had a second opinion at the top department in the country (family happens to live in that city so did it when I was home, 1000 miles away on a visit) for something else and found out locally they were wrong (I was pretty sure they were wrong due to looking up the disease and not having the symptoms but needed confirmation - turns out locally they did the scan wrong and interpreted it wrong - again the university medical center).

In a month I am having a telehealth apt with someone about an issue (one of the top people in the country with respect to this issue) that locally they know little about (it is about 2500 miles away if I had to drive).

I couldn't do most/all of that with limited networks. And I sure couldn't do that at all three places of choice if I had a MAP based on what those places do or don't accept (and all 3 are out of state). This matters when you need it. A lot.

And with respect to switching from a MAP to OM and supp - who knows if you'd even pass medical underwriting when you need better networks and access to care. Sure there are a few areas of the country where there is very good care and those centers accept at least one MAP so you can switch (hopefully in time) MAP's if you needed to use that particular system, but in many areas of the country that is not an option.

- 17,167

I don't even understand all the complicated math that some of you are using to figure this out. I have limited amount of formal schooling myself so I have to figure things out the way they make sense to a simple man.

When you took plan F's monthly premium and multiply it by 12-months and compared it to Plan G's the difference in premium was ALWAYS more than the cost of the Medicare Part B deductible. That deductible is the only difference between those two plans as long as you were looking at plans sold after June 1st 2016 (Known as the greatest day in history for Medicare agents).

Every time a rate increase was announced on existing biz Plan F almost always had a higher percent that the plan increased than Plan G or Plan N did. Not 100% of the time but very close. In fact with Aetna around 2019ish, their rate announcement has a REDUCTION of premium for existing Plan G but a rate increase for Plan F.

In my experience when you explained this information to your Medicare supplement customers at least 90% of them chose a Plan G or Plan N only a small handful. Would take a plan F. (I would never tell anyone of rate reductions because that is unlikely to ever happen again.)

In none of this am I referring to a high deductible G or F. Those are different animals.

When you took plan F's monthly premium and multiply it by 12-months and compared it to Plan G's the difference in premium was ALWAYS more than the cost of the Medicare Part B deductible. That deductible is the only difference between those two plans as long as you were looking at plans sold after June 1st 2016 (Known as the greatest day in history for Medicare agents).

Every time a rate increase was announced on existing biz Plan F almost always had a higher percent that the plan increased than Plan G or Plan N did. Not 100% of the time but very close. In fact with Aetna around 2019ish, their rate announcement has a REDUCTION of premium for existing Plan G but a rate increase for Plan F.

In my experience when you explained this information to your Medicare supplement customers at least 90% of them chose a Plan G or Plan N only a small handful. Would take a plan F. (I would never tell anyone of rate reductions because that is unlikely to ever happen again.)

In none of this am I referring to a high deductible G or F. Those are different animals.

just-a-client

Expert

- 48

I've had issue age Plan F since I was 65. That was 7 year ago.Your mistake was selling Plan F at all. Plan G was the much better plan if they wanted to save money and have lower rate increases.

I never saw a plan F that made any mathematical sense. Only used it in GI situations.

My premium today is $184.

The cheapest Plan G a 72 year old could buy today in my market is age-attained $171. If you factor in the Part B deductible, that costs very slightly more than my Plan F.

Also: back in 2017, Plan F was usually cheaper than Plan G + deductible. Not all firms were even selling G then, so perhaps the pricing anomaly was that the G pools were smaller and the G market less competitive.

It's true that my positive experience over 7 years is not 10 or 15 years of experience, and I don't know what the future will bring. If things eventually go wrong, fortunately I have the birthday rule to bail me out.

The math I used was simple math. Supp plan premium total for a year plus MOOP for that plan = total cost in a year if you used the total MOOP. Of course if you don't go to the doctor much right now you wouldn't use the total MOOP and so premium/yr plus what you spent in addition the total spent that year would be less. The comparisons may then end up differently. I figured it as if you used the total MOOP as that is worst case scenario for what you'd have to spend in a year.I don't even understand all the complicated math that some of you are using to figure this out. I have limited amount of formal schooling myself so I have to figure things out the way they make sense to a simple man.

When you took plan F's monthly premium and multiply it by 12-months and compared it to Plan G's the difference in premium was ALWAYS more than the cost of the Medicare Part B deductible. That deductible is the only difference between those two plans as long as you were looking at plans sold after June 1st 2016 (Known as the greatest day in history for Medicare agents).

Every time a rate increase was announced on existing biz Plan F almost always had a higher percent that the plan increased than Plan G or Plan N did. Not 100% of the time but very close. In fact with Aetna around 2019ish, their rate announcement has a REDUCTION of premium for existing Plan G but a rate increase for Plan F.

In my experience when you explained this information to your Medicare supplement customers at least 90% of them chose a Plan G or Plan N only a small handful. Would take a plan F. (I would never tell anyone of rate reductions because that is unlikely to ever happen again.)

In none of this am I referring to a high deductible G or F. Those are different animals.

- 17,167

With Plan F your total max out-of-pocket is the total of your premiums.The math I used was simple math. Supp plan premium total for a year plus MOOP for that plan = total cost in a year if you used the total MOOP. Of course if you don't go to the doctor much right now you wouldn't use the total MOOP and so premium/yr plus what you spent in addition the total spent that year would be less. The comparisons may then end up differently. I figured it as if you used the total MOOP as that is worst case scenario for what you'd have to spend in a year.

With Plan G your total max out-of-pocket is your premiums plus your part B deductible.

It's not complicated. And it doesn't change. Just assume they will go to the doctor enough to pay out their deductible.

And that is exactly what my spreadsheet showed. The original question I was responding to also included/implied high deductible F and G which why I have included tham.With Plan F your total max out-of-pocket is the total of your premiums.

With Plan G your total max out-of-pocket is your premiums plus your part B deductible.

It's not complicated. And it doesn't change. Just assume they will go to the doctor enough to pay out their deductible.

Similar threads

- Replies

- 5

- Views

- 246

- Replies

- 176

- Views

- 6K

- Replies

- 0

- Views

- 294

Latest posts

-

-

-

-

Postage going up another 7.4%. Legitimate dm has a few yrs left

- Latest: myinsurebiz