Jack Kelly

New Member

- 1

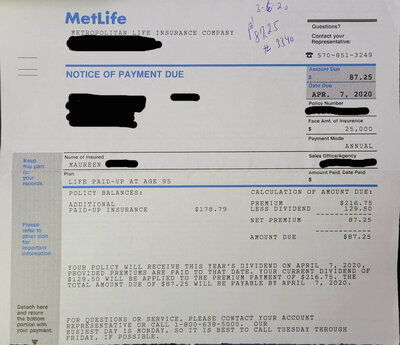

Can some tell me what info I need to request from MetLife. My father has been paying on this for 55 years, since I was born. I would like to find out how much and what my options are. I am contemplating retirement and want to have everything known, in case of emergency. Should I cash it out now or are there other options I should look at?

Sorry for the basic question. I just do not trust anyone as I get older

I attached the only statement we have from MetLife.

Sorry for the basic question. I just do not trust anyone as I get older

I attached the only statement we have from MetLife.