NY independent

Super Genius

- 114

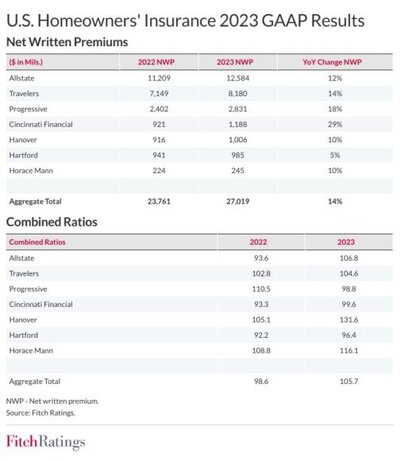

Has anyone seen the year end numbers for stock carriers? Travelers, CNA, Allstate, Progressive, Cincinnati, Chubb, AIG.....?

Some are reporting billions in net income yet they are still saying they are not rate adequate on personal lines yet. Some are still laying off employees and cutting agent's compensation packages, terminating, etc. Clients are starting to call in and aren't happy. It's tough to defend carrier profitability when the results indicate otherwise. I know carriers base rate increases on individual state performance, but this is big time corporate greed.

Some are reporting billions in net income yet they are still saying they are not rate adequate on personal lines yet. Some are still laying off employees and cutting agent's compensation packages, terminating, etc. Clients are starting to call in and aren't happy. It's tough to defend carrier profitability when the results indicate otherwise. I know carriers base rate increases on individual state performance, but this is big time corporate greed.