Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Most carriers are reporting positive 2023 year end results but rate increases continue

- Thread starter NY independent

- Start date

- 1,506

@marindependent nails it.

Imagine saying to your boss or stockholders. We grew NWP 13% knowing every policy we sold was unprofitable!

Newbies don't understand, carriers are not interested in growing (accidentally) more than they already are; UNPROFITABLY)

Imagine saying to your boss or stockholders. We grew NWP 13% knowing every policy we sold was unprofitable!

Newbies don't understand, carriers are not interested in growing (accidentally) more than they already are; UNPROFITABLY)

- 2,375

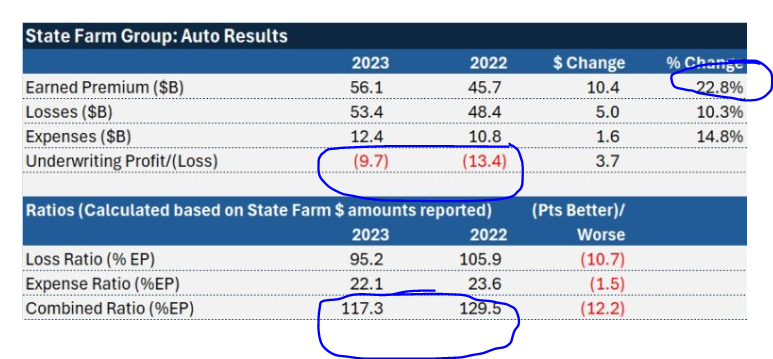

Lets hammer this one so hard the door is closed for good on this topic for 2023/2024. State Farm - Who is probably the largest personal lines insurer in the Country,just reported this: "The 2023 underwriting loss, combined with investment and other income of $5.6 billion, resulted in a P-C pre-tax operating loss of $8.5 billion, which compares to the $8.3 billion loss reported in 2022."

State Farm Source

State Farm Source

- 4,988

Not so fast.Lets hammer this one so hard the door is closed for good on this topic for 2023/2024. State Farm - Who is probably the largest personal lines insurer in the Country,just reported this: "The 2023 underwriting loss, combined with investment and other income of $5.6 billion, resulted in a P-C pre-tax operating loss of $8.5 billion, which compares to the $8.3 billion loss reported in 2022."

State Farm Source

Being an optimist, these sound like improvements. SF made a lot of changes in 2022 & they look like they paid off in a huge way.

Here me out.

Rate increases & inflation grew their total premiums by 10-15%, so $200M more in net operating losses is likely an improvement as a %.

If premium was around $200B in 2022 & now $225B, math is 2022 was a -4.15% underwriting loss & 2023 was -3.78%.

Putting my insurance commissioner hat on, this looks like consumer price gouging to have a big bad insurance carrier improving their profits by 10% last year while consumers are hurting. They should have lost $9.4B, and should refund the the $900M they didn't lose.

And if you turn a scale upside down, you could weigh the world!Not so fast.

Being an optimist, these sound like improvements. SF made a lot of changes in 2022 & they look like they paid off in a huge way.

Here me out.

Rate increases & inflation grew their total premiums by 10-15%, so $200M more in net operating losses is likely an improvement as a %.

If premium was around $200B in 2022 & now $225B, math is 2022 was a -4.15% underwriting loss & 2023 was -3.78%.

Putting my insurance commissioner hat on, this looks like consumer price gouging to have a big bad insurance carrier improving their profits by 10% last year while consumers are hurting. They should have lost $9.4B, and should refund the the $900M they didn't lose.

- 2,375

You are cracking me up @Allen Trent

"A year after recording the largest underwriting loss in the company's 100-year history, State Farm eclipsed it in 2023."

IJ

"A year after recording the largest underwriting loss in the company's 100-year history, State Farm eclipsed it in 2023."

IJ

- 1,506

Newest article on their 2023 Losses:

www.insurancejournal.com

www.insurancejournal.com

State Farm Sets Another Record With $14B Underwriting Loss in 2023

A year after recording the largest underwriting loss in the company's 100-year history, State Farm eclipsed it in 2023. The underwriting loss figure

www.insurancejournal.com

www.insurancejournal.com

- 4,988

You are cracking me up @Allen Trent

"A year after recording the largest underwriting loss in the company's 100-year history, State Farm eclipsed it in 2023."

IJ

But they also increased their value by $3,600,000,000 according to the article. that is going to rile up some politicians & regulators that cant do math or understand why

- 4,988

See, I was right. Auto company collected a whopping 22.8% more premium ($10.4B in real dollars) & doubled their Auto profits for the year from minus 29.5% to minus 17.3%Newest article on their 2023 Losses:

State Farm Sets Another Record With $14B Underwriting Loss in 2023

A year after recording the largest underwriting loss in the company's 100-year history, State Farm eclipsed it in 2023. The underwriting loss figurewww.insurancejournal.com

They are doing awesome, right? Someone that weighs 900 pounds & loses 200lbs is making great strides & much improved

- Thread starter

- #20

NY independent

Super Genius

- 121

Does this translate into further rate increases? Layoffs? Commission reductions? Maybe they should consider stopping the spend on ads featuring sports people and celebrities and focus on core operational improvement. Revamp the products to ACV only etc, buy building materials and car parts directly from manufacturers, and have their own body shops and building contractors to make repairs. Non renew all frequency and shock customers nationwide (better to pay the fines to the states than to continue the claim cycle).

Similar threads

- Locked

- Sticky

- Replies

- 0

- Views

- 200

- Replies

- 16

- Views

- 3K

- Replies

- 3

- Views

- 2K

- Poll

- Replies

- 1

- Views

- 448

Latest posts

-

-

-

-

Why are United American rates for Medicare Supplement Plan G and N so high?

- Latest: AllThingsMedicare