- 11,396

I am actually ALL FOR THIS!! With the ongoing misrepresentations of IUL and other policies, I think this is a good step in the right direction.

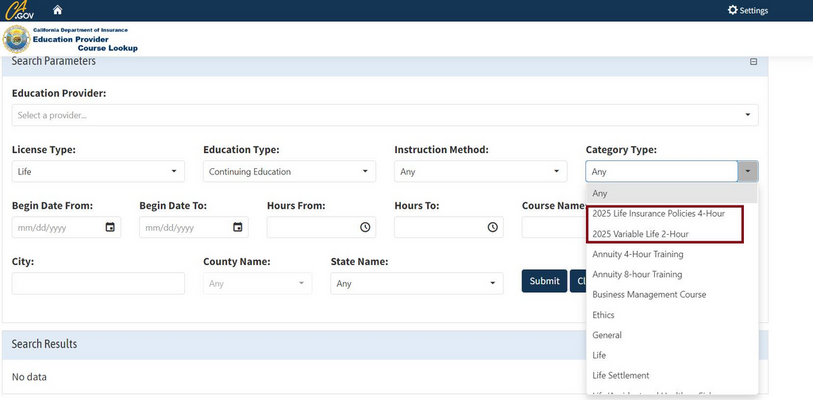

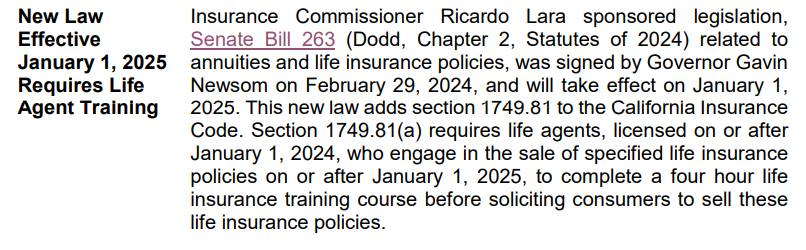

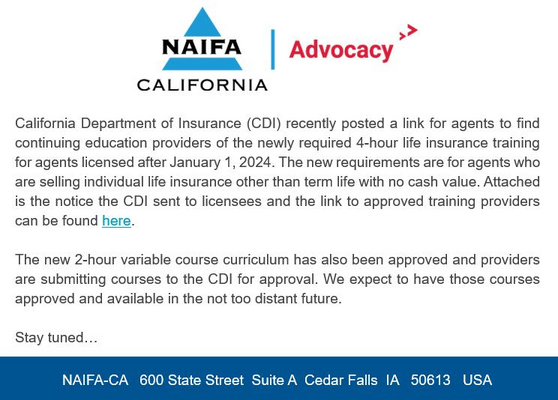

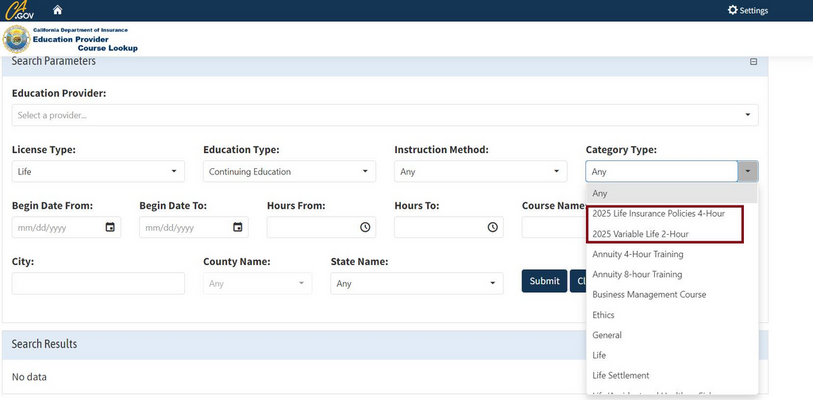

Now the notice says it's for agents licensed after January 1st, 2024... but I believe it's for agents who continue to be licensed and renew their licenses after January 1st, 2024. Not 100% certain, but that would sound better to me.

Now the notice says it's for agents licensed after January 1st, 2024... but I believe it's for agents who continue to be licensed and renew their licenses after January 1st, 2024. Not 100% certain, but that would sound better to me.