- 10,830

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ohio National and Constellation

- Thread starter Lloyds of Lubbock

- Start date

- 5,048

If we could only guarantee that the carrier with convertible term will have a quality participating WL that permits PUAR utilization for max funding. However, I have never seen a conversion privilege say what you can convert to in the futureJust thinking out loud here David.... you admit the equities build a larger pot of money.... I admit that the WL provides a higher payout rate....

So.... would the ideal plan not be buy convertible term, invest difference, and then convert 10 years from retirement and put the equities into the WL at that point? I mean, why put $400k into WL when you can put $1.7m into WL?

Obviously its not as cut and dry as that. But the real answer is that nothing is the one single answer. Asset diversification is key to a safe retirement. Even diversification within the same asset is smart... such as not putting all your eggs in the same WL product, or IUL product, etc. Clients can get one of each, one from each carrier, etc. And that is a very smart thing to do as we all see from the current ON debacle.

- 5,048

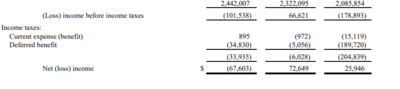

BTW. This is why ON sold out for $500m

They took a $67,000,000 loss in 2019.

Not much in profits before that. They are killing the Dividend for sure. And to think they were promoting their "financial strength" after taking that loss....

That is from when AM best slightly downgraded & changed from positive to neutral and when they stopped certain annuities & announced they would be letting $20B of annuity burn out over time. Guessing that loss was some sort of accounting for valuation of assets held, not losses from operations.....but that is merely speculation on my part

Sure it does. It just says, "whatever we offer at the time of conversion".However, I have never seen a conversion privilege say what you can convert to in the future

And unfortunately, that's the strongest language, not the weakest...

They should have had a huge gain from shutting off trails on their VAs.That is from when AM best slightly downgraded & changed from positive to neutral and when they stopped certain annuities & announced they would be letting $20B of annuity burn out over time. Guessing that loss was some sort of accounting for valuation of assets held, not losses from operations.....but that is merely speculation on my part

- 10,830

That is from when AM best slightly downgraded & changed from positive to neutral and when they stopped certain annuities & announced they would be letting $20B of annuity burn out over time. Guessing that loss was some sort of accounting for valuation of assets held, not losses from operations.....but that is merely speculation on my part

Maybe I will dig deeper and see. Of course being a mutual, they disclose what they want to beyond state regulations... which is essentially nothing.

- 10,830

They should have had a huge gain from shutting off trails on their VAs.

Anyone contracted with ON knows exactly why they got in financial trouble....

All that damn junk mail they sent every single week to our offices... even after no longer having a contract with them they still sent it....

Im joking, but things like that add up for a large company. What else was slipping through the cracks to cause that loss??

- 5,048

Sure it does. It just says, "whatever we offer at the time of conversion".

And unfortunately, that's the strongest language, not the weakest...

Agree, but it rarely says to any permanent plan we are selling. Many state convert to a plan we offer for conversion & that may be a product they only offer for conversion priced based on not being underwritten & little or no dividends compared to a more quality product they offer to newly underwritten customers

- 5,048

Maybe I will dig deeper and see. Of course being a mutual, they disclose what they want to beyond state regulations... which is essentially nothing.

So, you are making a case for how demutualization will benefit the policyholder with more transparency?? Just joking

- 5,048

Maybe I will dig deeper and see. Of course being a mutual, they disclose what they want to beyond state regulations... which is essentially nothing.

They spell it out here & say it is common with how their accounting works & how it also happened in other good economic years in the past decade.

Sounds like they spent a lot of money to buy out clients out of the GMIB VA contracts (never understood how this passes the FINRA -SEC best interest rules, etc by charging fees for years for a rider & then deciding you cant afford to offer it so lets bribe the client out of the too lucrative of a contract feature)

https://www.ohionational.com/portal...woid=5224bdab08011710VgnVCM1000000414650aRCRD

Similar threads

- Replies

- 1

- Views

- 264

- Replies

- 9

- Views

- 2K

- Replies

- 2

- Views

- 955

- Replies

- 1

- Views

- 292

- Replies

- 0

- Views

- 191