I suggest you read every word on every contract you ever sign.

But some insurance companies contracting, it has something that most people never notice.

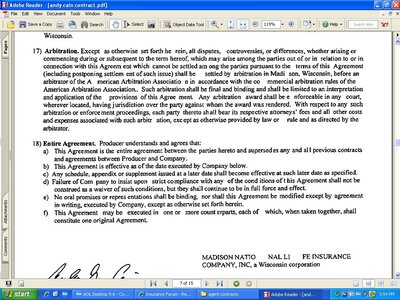

What I call the "mediator clause"

That basical says if you dont agree with anything, like a debit balance, you have to fly to city and state that the pick on their contract and go in front of a mediator.

Would you pay for a flight and hotel for a small debit?

Most people would not pay for a hotel and flight, to fight over a $500 debit. They would only break even if they won.

Dont forget the insurance company makes the contract that you sign.

Madison National Life has this on their contracting.

But some insurance companies contracting, it has something that most people never notice.

What I call the "mediator clause"

That basical says if you dont agree with anything, like a debit balance, you have to fly to city and state that the pick on their contract and go in front of a mediator.

Would you pay for a flight and hotel for a small debit?

Most people would not pay for a hotel and flight, to fight over a $500 debit. They would only break even if they won.

Dont forget the insurance company makes the contract that you sign.

Madison National Life has this on their contracting.