- Thread starter

- #11

well i should point out once the alert system is created, there are going to 1,000s of ULs that are struggling

Yes, my client spoke with her mass mutual agent

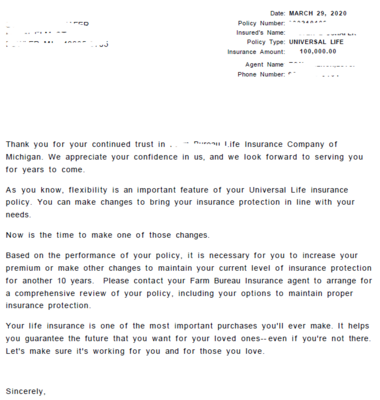

I only brought this up because I've had 3 in my first year. All of them said they never received any communication. (But I know how that goes...)

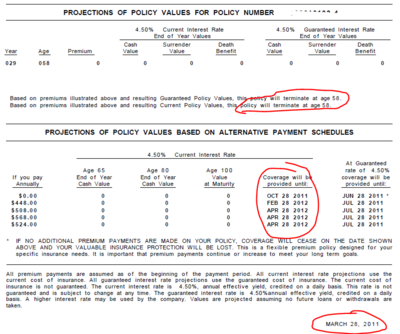

$450 per year, for 40 years, to get a $125k DB and $11k in cash. Is actually a pretty damn good deal.

She could walk right now and only have paid $7k total for 40 years of a $125k DB.

I assume you looked at ways to save the existing policy before attempting to write a new policy... because it is extremely likely that modifying the existing policy would be the right thing to do based on the numbers you gave.

Yes, my client spoke with her mass mutual agent

Yes it's a terrible shame. Great to hear that insurers were doing something.My first dip into the business included a very short stint as a captive agent at Prudential. I spent almost all of my time running appointments with orphaned VUL clients who's policies were imploding. Seeing how these things were sold made me pretty sick. They were college funding devices. They were retirement savings accounts. They were this and that. Its like no one knew they were buying frigging insurance. I'm glad that I was able to pair up with an independent guy and get out of that mess, because seeing all of these people realize that their dreams were gone was like watching babies drown.

I only brought this up because I've had 3 in my first year. All of them said they never received any communication. (But I know how that goes...)