- Thread starter

- #11

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Wife wants an annuity but which one?

- Thread starter obewan

- Start date

- 5,276

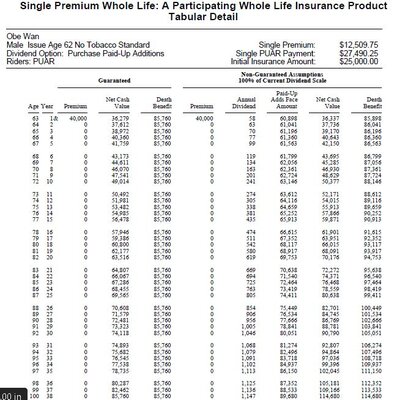

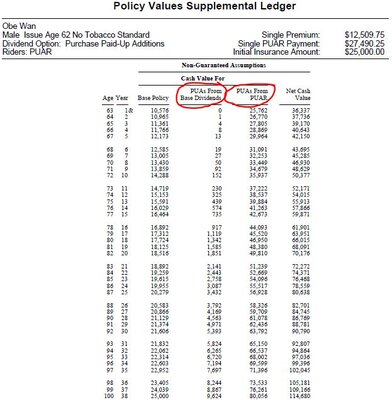

you may really want to try to find a SPWL policy like the following attachments. 75% of the money into the PUAR values. If the hopefully never needed emergency happens, the PUAR values on the 2nd document can be partially surrendered or you could borrow it if you know you want to pay back. Lifetime distributions are taxed just like a NQ Annuity would be, but if you never have that "hopefully never needed emergency" the death benefit passes tax free. Tax deferred cash growth while alive like NQ annuity, but Tax free death benefit at death like life insurance. your wife might need that extra tax free life insurance if you die to offset Soc Sec reduction, etc.I should have described it as something other than emergency. We do have an emergency fund. Not sure what to call it when it's something you don't really need for your living expenses. Just wanted to put it into some product where I could get a commission on.

Note--not trying to sell you this product or get you to sell it. It is with single state company with multiline captive PC agents. Just trying to show you another possible option. Seniors love it with their lazy bank type money as it lines up many times with what they want their safe money to do. (no probate, tax deferred while alive, tax free at death, emergency access if needed, etc). EIA is also a great option & will likely outperform as a net after tax death benefit in years 20+ if it averages 5-7% each year. But, Annuities are an inefficient vehicle tax wise at death. Many seniors pay low or no income taxes, so Annuity money not used during lifetime passes the income tax bill on all the deferred gains. The tax rate tends to be much higher on the beneficiary who is either in a higher tax bracket in general or jumps into high tax brackets temporarily from inheriting Annuities & other taxable retirement accounts.

Attachments

insuranceguy72

New Member

- 2

I'd check out the Legacy/Americo products. Great accumulation with 10% free withdrawals. LibertyMark and ClassicMark. My clients are getting great returns

"... that she would periodically take out for emergencies only." Why would you put money that's potentially going to be needed when the car breaks down in an annuity?If this is really not needed for income (Live on Money) & only for emergency with hopes it will be "leave on" money, you might also want to investigate Single Premium WL, especially with a carrier that allows 50-75% of the money to be in the PUAR fund. The PUAR fund can be pulled out or borrowed at anytime.

SPWL withdrawals/distributions are treated just like a NQ annuity in that you have to take out your taxable gains 1st if you take money out, but a SPWL is 100% tax free when you die compared to NQ Annuity having a tax bill to the beneficiaries on all the built up gains.

NQ annuity are great to use for living on, but they can be inefficient tax wise to leave to beneficiaries, especially when you consider that most seniors are in the 0% or very low tax bracket, meaning they are deferring taxes each year on a NQ annuity only to build up larger gains to leave to beneficiaries who are many times in a higher tax brackets, especially when they receive a lump sum annuity payout with gains taxable.

If you are insurable & you guys already have adequate emergency funds & retirement savings, putting the SPWL on your life could also benefit your wife if you passed away. This extra boost from the death benefit would help her offset lost SS income, pension, etc. $40k into a SPWL might provide $100k or more of tax free life insurance to the beneficiary in addition to growing if it is with a carrier with good dividends & the PUAR component.

- Thread starter

- #15

- 11,556

That poster is some kind of strange spam-bot - just re-quoting someone else and making it look like it was their own unique response. That profile needs to be banned and deleted.

You might want to make sure that you have put in all the necessary requirements to get paid - there usually is a pre-req CE course for annuities that you have to do (in addition to any carrier requirements).I deal with Medicare products for seniors and very few annuities. Set my sister up with one and also a cousin.

I really only know the basics. Any recommendations for a 62 year old female (wife) who doesn't really need the income from it. It would only be about a 40,000 annuity, that she would periodically take out for emergencies only. Unless there's a different product I should look into. Of course I would also look at commission level and contracting, in order to be a part of my book of business.

Similar threads

- Replies

- 5

- Views

- 3K