Why did annuitizing the contract create a commissionable event?Yup, just did that in October with client that had turned 100 last summer...and agent even got paid 3% for something that had been on deposit for almost 40 years.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Age 100 maturity NQ annuity

- Thread starter Allen Trent

- Start date

- Thread starter

- #22

- 5,044

carrier pays commission on payout annuities/SPIA when owner annuitizes if contract already inforce more than 8 years & also on all death claims of annuity & life policies that go into a payout annuity.Why did annuitizing the contract create a commissionable event?

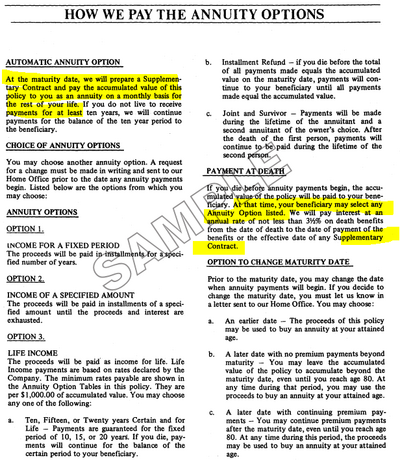

Death claims of Annuities( both qualified & non qualified) should many times consider utilizing the contract guaranteed payout tables. Beneficiaries can avoid a lump sum taxation (entire amount on qualified or taxable gains on NQ) & instead spread the taxation out over 10 year fixed period payout on qualified or longer in some NQ annuity.

it is crazy to me how many agents dont know what they are doing on death claims & do so many lump sum settlement options on annuity death claims. Too late once claim is paid out & beneficiaries find out the hard way when they file their tax return how much they owe in taxes.

Utilizing Annuitization is a lost art for owners (when need lifetime income or go in nursing home or annuity matures) and for beneficiaries at claim time.

Old annuity contracts were priced under shorter life expectancy mortality tables & higher interest rate guarantees, meaning in addition to the taxation being spread out on annuitization, the payout might also be advantageous because of the higher embedded interest rates and/or shorter life expectancy built into the tables compared to current product offerings.

Excuse my dunderheadedness - How could a SPIA annuitize after being in-force >8 years? The 'I' is 'Immediate' as you know. That does not make sense to me.carrier pays commission on payout annuities/SPIA when owner annuitizes if contract already inforce more than 8 years & also on all death claims of annuity & life policies that go into a payout annuity.

What is a payout annuity?

- 10,830

Excuse my dunderheadedness - How could a SPIA annuitize after being in-force >8 years? The 'I' is 'Immediate' as you know. That does not make sense to me.

What is a payout annuity?

We are talking about Deferred Annuities. Not SPIAs.

It was a deferred fixed annuity (like a MYGA or a traditional fixed) that was then annuitized (which you can do with any annuity) after 8 years.Excuse my dunderheadedness - How could a SPIA annuitize after being in-force >8 years? The 'I' is 'Immediate' as you know. That does not make sense to me.

What is a payout annuity?

- Thread starter

- #26

- 5,044

agents, consumers & carriers interchangeable use different words to call lifetime or fixed period checks different things.Excuse my dunderheadedness - How could a SPIA annuitize after being in-force >8 years? The 'I' is 'Immediate' as you know. That does not make sense to me.

What is a payout annuity?

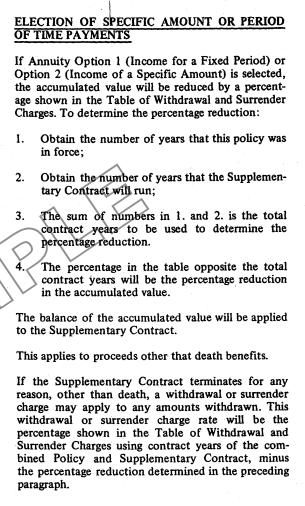

if you look at contract language, it might say "supplementary contract" A death claim form might call it "payout Annuity". A new application might call it "Single Premium Immediate Annuity"----they all mean the same thing--exchanging a lump sum in exchange for a guaranteed stream of payments.

Agent commission schedule might have different sections for new external money going into Single Premium Immediate Annuity & another section may have different rates & stipulations if the guaranteed income is from internal money or death claim.

- Thread starter

- #27

- 5,044

or life contracts. Most agents dont know that clients can annuitize their UL, IUL, VUL or WL policy cash values for a guaranteed income streams. Seen consumers cash in life policies after not wanting to pay premiums anymore & sometimes have taxable gains if they made money & could have annuitized per contract language for a stream of income to spread taxes out.It was a deferred fixed annuity (like a MYGA or a traditional fixed) that was then annuitized (which you can do with any annuity) after 8 years.

- Thread starter

- #28

- 5,044

definitely look in the back of any Life or Annuity policy you own or have sold. All of them will have entire sections about turning the account values or the death claim into a stream of incomeExcuse my dunderheadedness - How could a SPIA annuitize after being in-force >8 years? The 'I' is 'Immediate' as you know. That does not make sense to me.

What is a payout annuity?

old 1983 annuity contract, but old life contracts also have similar language along with new Life & Annuity contracts

Similar threads

- Replies

- 5

- Views

- 2K

- Replies

- 10

- Views

- 1K