- 11,554

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

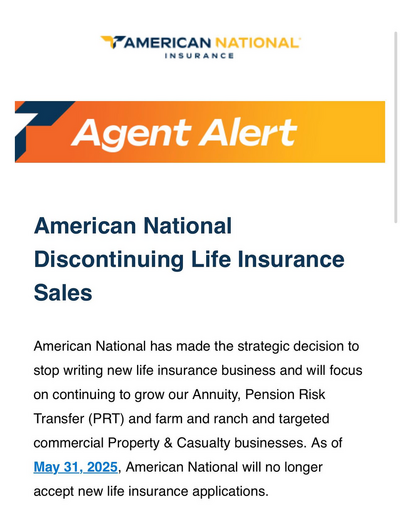

American National discontinuing life insurance sales

- Thread starter DHK

- Start date

- 11,015

Interesting development.

Sheryl J Moore

Super Genius

- 102

I would anticipate that the private equity ownership will change the focus of the company to indexed annuities. Expect for them to increase the competitiveness of their offering.

- 7,276

I would anticipate that the private equity ownership will change the focus of the company to indexed annuities. Expect for them to increase the competitiveness of their offering.

I was considering purchase of an American National FIA. One of the reasons was its provisions were simple and easy for me to understand.

I attempted to ask for agent input here on its usefulness as an accumulation vehicle in another thread but that discussion got derailed.

I have no idea if the products displayed are More or Less competitive, but American National's rate sheet with March effective date has gone from a simple and easy (for me) to understand document 1 page long to a 2 page document (containing lots of room for product additions) with more complicated annuity terminology which I do not understand.

This combined with market hits, my agent dragging feet on getting American National contracted, and lower American National MYGA rates in the March sheet, (As well as lower than other carrier LPA percents (at least when I checked late last year)) are leading me to switch the carrier I will consider for my next annuity purchase.

If my agent has finally gotten American National contracted, he is not going to be happy with me but I am not going to tie my money up in a 7 year surrender charge product that I do not understand and is probably now not useful to me anyway. If he'd gotten contracted when I first asked, he'd have the business written and in force now and I'd have had something I understood and had utility to me.

Sheryl J Moore

Super Genius

- 102

I am happy to help you understand the annuities, if you are so inclined. I can email you the product specifications for the new products, if you want to email me.

- Thread starter

- #6

- 11,554

Sheryl - fair 'warning', but he's not an agent. Just FYI.I am happy to help you understand the annuities, if you are so inclined. I can email you the product specifications for the new products, if you want to email me.

Sheryl J Moore

Super Genius

- 102

How did you know that? I must not be sophisticated when it comes to I-F.

- 7,276

Should I choose to ask, She did offer help to readers of one of her books, which @MTC recommended and I have purchased. I can ask her one or two questions via PM here or to her business email on that basis, and in that communication make it clear I am a reader of her book, not an agent that can afford to purchase her business services.Sheryl - fair 'warning', but he's not an agent. Just FYI.

She has also made it quite clear she WILL NOT recommend specific carriers or products, which is why I did not attempt to address her specifically when I originally started a thread to ask agents here about the accumulation potential for the American National ASIA annuity (or to make my comment above questions instead of comment). Her passion in regard to annuities is similar to one of yours with life insurance, education.

I did not put my normal caveat on my comment above because in my very first sentence of the comment I used the word purchase, which I thought was an adequate expression of intent as opposed to agent, FMO, or selling.

Age and new financial constraints not present in January make purchasing an American National FIA much more problematic for me now than it was in January. Additionally I have to consider two of Stan's comments.

If you can't explain it (the annuity you are considering) to a 9 year old (no offense to 9 year olds) --- I don't remember the rest word for word, conceptually its -- it is probably not a wise purchase for you.

And

Bonuses are candy for the stupid. There are only so many pennies in the dollar.

Stan's 2 comments raise significant red flags for me relating to the ASIA 7 now. In January with higher american National 5 year MYGA rates and a simple ASIA 7 structure and not knowing some financial events that were to come, an American National 5 yr MYGA coupled with a 7 year flexible premium FIA would have been quite useful for my retirement financial planning. Now they're not. And the question soon becomes academic because of my age.

So, I don't intend to pursue understanding the American National annuities with her because it will be a waste of time for both of us.

For the past several weeks while studying out flexible premium annuities, I have off and on been considering whether there are any generalized annuity concept questions I can ask her to benefit from her knowledge and experience. So far I have not come up with anything except one question which would be a very large ask and I am not yet sure I really need.

A couple of flexible premium annuity questions are developing in my mind, but I think they are probably more agent product and experience specific than a generalized question she would care to comment on.

- 7,276

Because he and I have communicated via PM about secondary market annuitiesHow did you know that? I must not be sophisticated when it comes to I-F.

And because I have begun a very high percentage of my posts for the last 4 or 5 years on the site with "Caveat, not an agent".

In addition the regular frequent posters in the annuity subforum have seen my posts asking for help regarding carriers or product purchases and know I am not an agent. I think I have pretty well used up that avenue of potential purchase help. I will say the agent I finally found to help me with my last two purchases was impressed with my product choices.

If I was an agent, I might consider asking you if I could purchase copyright rights to one of your annuity agent names (or ask you to come up with another one for me.) I was particularly taken with K the AS.

- 7,276

Caveat, not an agent.I am happy to help you understand the annuities, if you are so inclined. I can email you the product specifications for the new products, if you want to email me.

Before I had you spend that time for me, I'm pretty sure I could go to American National's website and get the product specifications, at least generally. (Well maybe not but I still don't want you to make that effort for me.)

The real problem for me is two-fold. Understanding what the technical jargon of the specifications means in a way I can picture what they actually mean and, where there are options, decide which option(s) to choose while using the annuity.

(That's where the other book @MTC recommended would come into play but it is both too long and too hard for me to understand to be able to use it at this time.)

Similar threads

- Replies

- 1

- Views

- 30

- Replies

- 20

- Views

- 4K

Latest posts

-

-

-

-

Are agents allowed to pay/gift for referrals?

- Latest: PrivClientSG